CSC DigiPay Commission Chart 2023

You are in this post means probably you are a CSC VLE or you are interested to Be a CSC VLE in the future. In this post, we will share with you CSC DigiPay Commission Chart 2022. We know most of the CSC VLE who use DigiPay don’t know the DigiPay Commission of all the Services like Cash Withdrawal, Cash deposit, DMT, Mini Statement, MATM Cash Withdrawal, Payout Charges, Wallet Tpoup Charges.

What is DigiPay in CSC?

DigiPay is an AEPS Aadhaar Banking Service provided by CSC e-Governance Services India Limited. CSC DigiPay allows bank customers to use their Aadhaar authentication to perform basic banking transactions. Customers can perform a balance inquiry, cash withdrawal, cash deposit, MATM withdrawal, or money transfer through CSC Centre by CSC VLE.

How to Download DigiPay New Version?

To Use all the latest services you have to Download DigiPay New Version for Mobile or Windows. For Download DigiPay you need to visit digipay csccloud in. There you can download the latest version DigiPay (v7.0) for Windows and Digipay v6.9 for Android.

How to DigiPay Install and DigiPay Login?

Before Installing DigiPay on your mobile or Windows you need to Install the proper RD Services for Biometric Devices. After Installing RD Services for Biometric Device install the DigiPay windows setup file or DigiPay APK version.

How to install DigiPay in Mobile and DigiPay Login?

- Download the DigiPay APK file

- Install Biometric Device RD Service

- Now open the APK file and Allow all permission

- It will Install on your Mobile

- Now Open the DigiPay Application

- Enter Your CSC ID

- Send OTP

- An OTP will be received on your Register Mobile

- Verify the OTP for the first Registration

- Now Plug in the Biometric Device on the phone

- Biometric Devices will register Automatically and be Ready to Use

- Now Open the DigiPay Application

- Enter Your CSC ID

- Select the OTP Method

- An OTP will be received on your Register Mobile

- Verify the OTP and Authenticate with Biometric

- DigiPay Dashboard will open

How to install DigiPay in windows 7 and DigiPay Login?

- Download the DigiPay exe file

- Install Biometric Device RD Service

- Before Install DigiPay remove the old version and its Source file from C Drive

- Restart the PC

- Now Install DigiPay and run the exe file

- Now Open the DigiPay Application

- Enter Your CSC ID

- Send OTP

- An OTP will be received on your Register Mobile

- Verify the OTP for the first Registration

- Now Plug in the Biometric Device on the PC

- Biometric Devices will register Automatically and be Ready to Use

- Now Open the DigiPay Application

- Enter Your CSC ID

- Select the OTP Method

- An OTP will be received on your Register Mobile

- Verify the OTP and Authenticate with Biometric

- DigiPay Dashboard will open

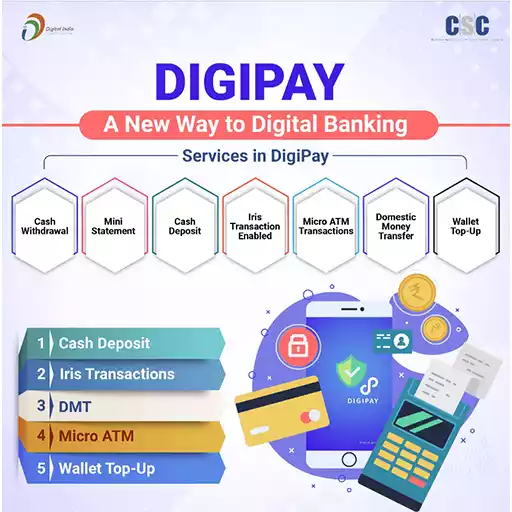

CSC DigiPay Services List 2023

- Cash Withdrawal

- Cash Deposit

- Mini Statement

- Balance Inquiry

- DMT

- MATM Cash Withdrawl

- Wallet Tpoup

Why should you use CSC DigiPay?

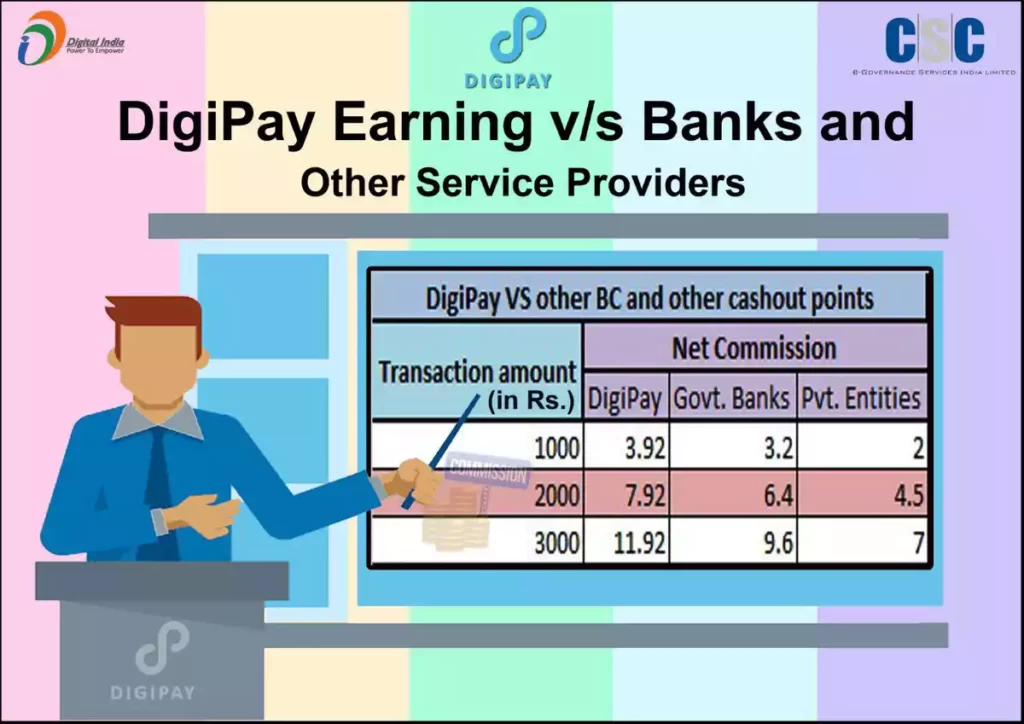

DigiPay is the most trusted and popular CSC AEPS Banking Service since the Beginning of AEPS by NPCI. DigiPay is the most used AEPS service because of its advanced features and highest commission over any other AEPS provider. Most AEPS user wants the latest features and a good commission on banking services that DigiPay Provides. Also, there has better DigiPay Support for any technical or transaction-related issue. You can raise a ticket for it or can contact us over the call at 14599 Toll-Free Number.

CSC DigiPay Commission for All Service

CSC DigiPay is one of the best AEPS Service providers that provide the highest commission to their VLE. There has a number of AEPS Service providers but their commission is greater than the CSC DigiPay Commission. All of the DigiPay services like Cash Withdrawal, Cash Deposit, DMT, Mini Statement, and MATM Cash Withdrawal have a good commission. Even, If we compare DigiPay to Any other Bank BC then there DigiPay is the better one.

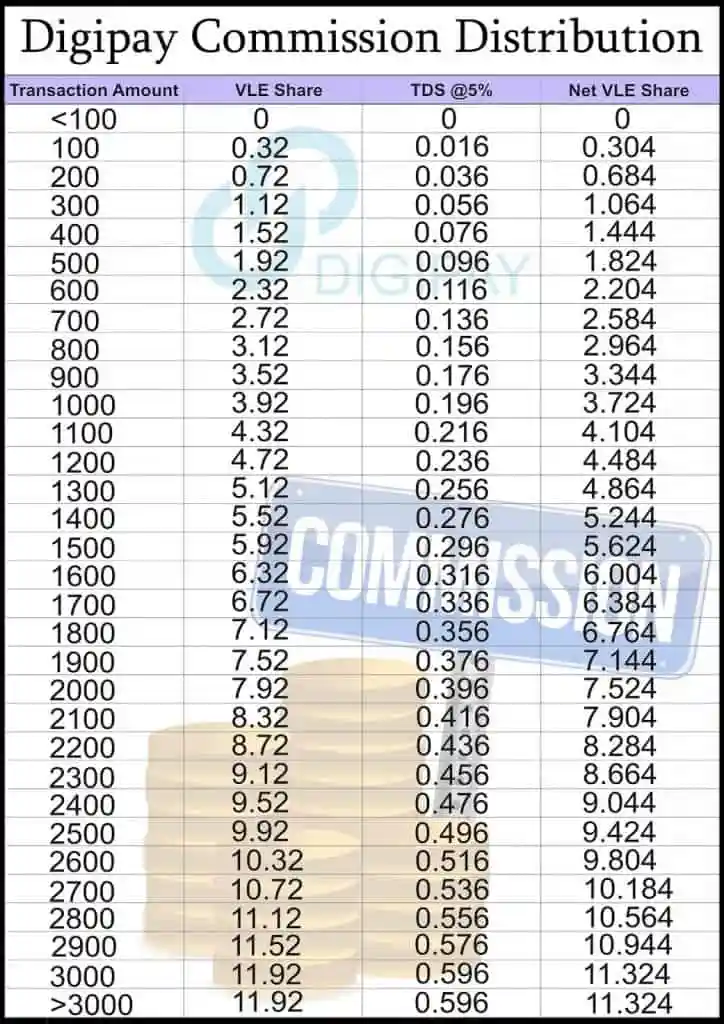

CSC DigiPay Commission on Cash Withdrawal

CSC DigiPay provided Commission on every Cash Withdrawal minimum of INR 100 to INR 10,000. There is the official list of the DigiPay Cash Withdrawal Commission Chart.

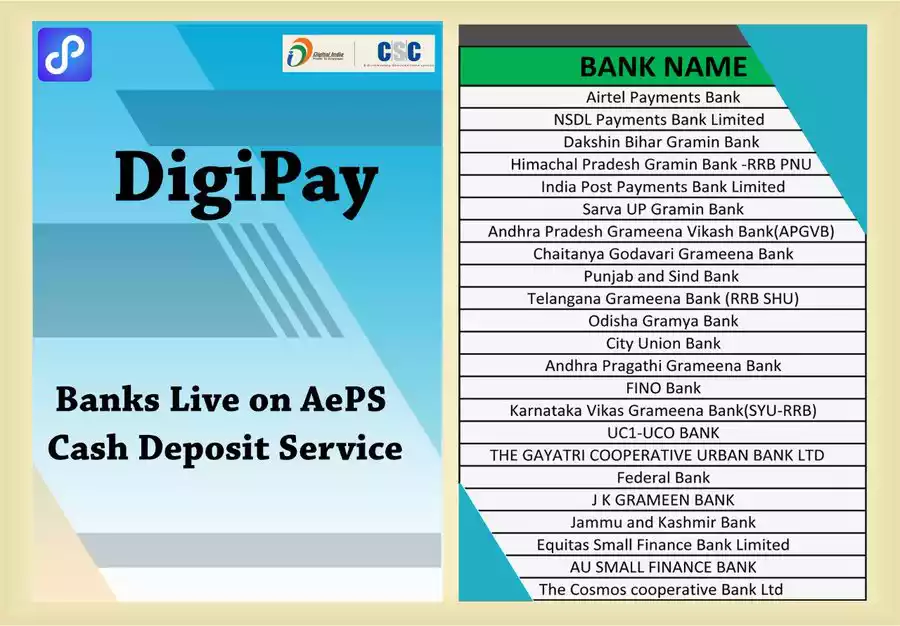

CSC DigiPay Commission on Cash Diposit

CSC DigiPay provided Commission on every Cash deposit minimum of INR 100 to INR 10,000. Even all the banks are not available for DigiPay Cash Deposit. There are only 23 banks that live for AEPS Cash deposits. There is the official list of DigiPay Cash Deposit available banks

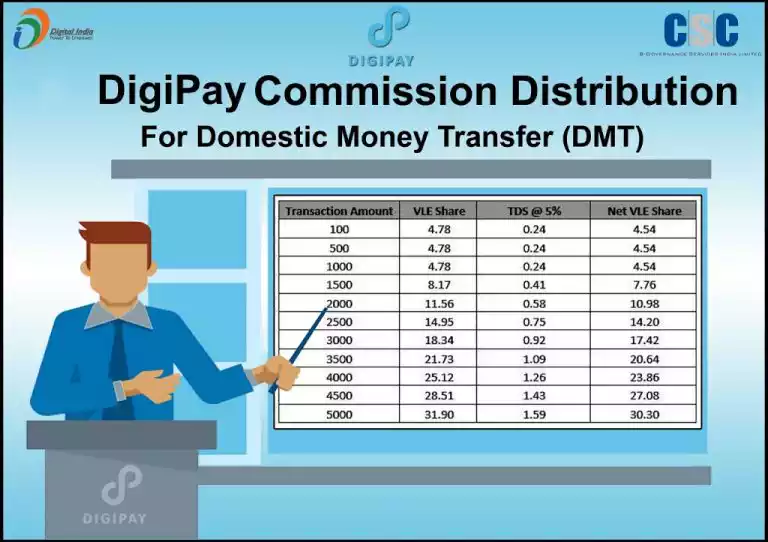

CSC DigiPay Commission on DMT

CSC DigiPay provided Commission on every Domestic Money Transfer (DMT). CSC DigiPay charges customers 1% of the Transfer Amount from DigiPay Wallet during DMT. From the 1% Charge, VLE gets the Share from DigiPay to DigiPay Wallet after the Successful Transaction. There is the official list of DigiPay DMT Commission Share.

How to Transfer Money from DigiPay?

- Go to the DigiPay Application

- Select DMT

- Before Register a Beneficiary you need to Register there

- Register a Benefisary Using Mobile OTP

- Now Select Benefisary and Fill in Account Details with IFSC Code

- Again Veryfi Benefisary details Using Mobile OTP

- Now enter the Amount to Transfer

- Transfer Amount 1% will be Charge for DMT

- Enter Your MPIN to process the Payment

- After a Successful Transaction, a receipt will Generate for the Customer

CSC DigiPay Commission on Mini Statement and Balance Inquiry

CSC DigiPay has no commission provided on Mini Statement and Balance Inquiry. Even, some of the AEPS providers provide commission on Mini Statement up to RS. 1

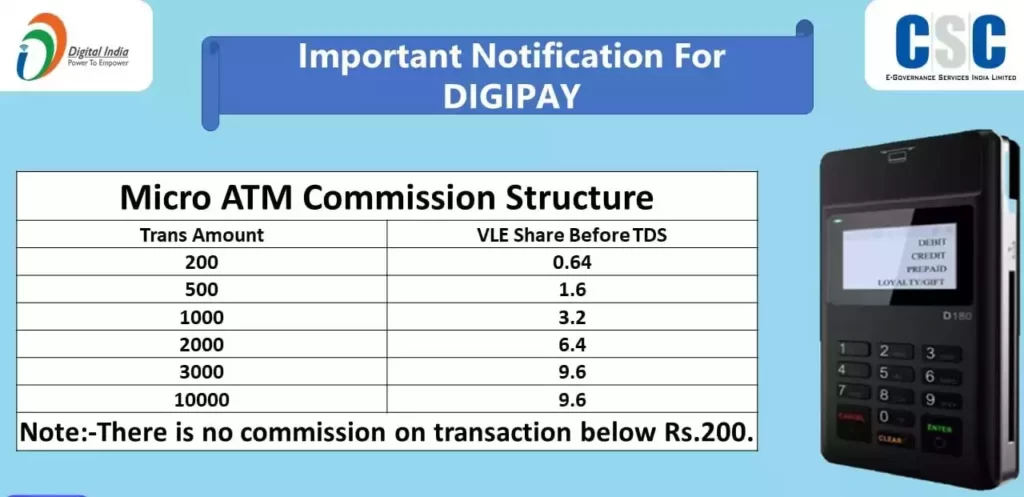

CSC DigiPay Commission on MATM

CSC DigiPay provided Commission on every MATM Cash Withdrawal minimum of INR 100 to INR 10,000. But on the MATM Balance inquiry, there have none any commission provided by DigiPay. There is the official list of DigiPay MATM Cash Withdrawal Commission Chart.

DigiPay Payout Charges

There are two methods for DigiPay Payout using NEFT and IMPS to your Register Bank Account.

- NEFT – This Payout method is free of charge, but the settlement time is more than 3 to 4 hr.

- IMPS – IMPS Payout method is chargeable but there has a real-time settlement. Up to 25,000 charges are INR 5.00 + GST and above 25,000 up to INR 2,00,000 charges are INR 10.00 + GST.

DigiPay CSC Wallet Tpoup Charges

DigiPay CSC Wallet Troup is free of charge. Without any charge, you can add money to your Digital Seva Portal very easily.

How to Transfer Money from DigiPay to CSC Wallet?

- Go to DigiPay Dashboard

- Select Wallet Topup

- Enter the Amount

- Agre to Consent tick the box

- Process for Biometric Authentication

- With Successful Wallet Topup, your DSP portal wallet will be credited

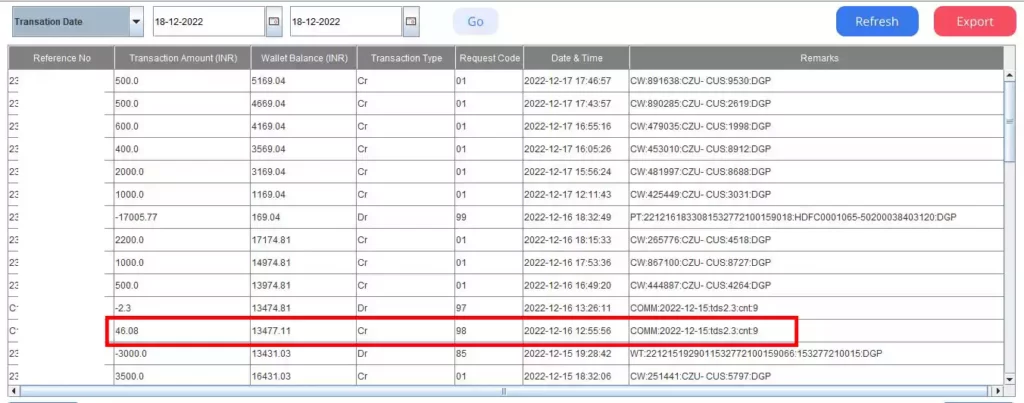

How to Check DigiPay Commission?

1. DigiPay provides Commission the very next day of the Transaction. To check it

2. Go to DigiPay Dashboard and click on passbook.

3. Check the Remarks on the Transaction List

4. You will find “COMM” with the Date

5. Check the Row on the Transaction Amount

6. This is your DigiPay Commission on that Day

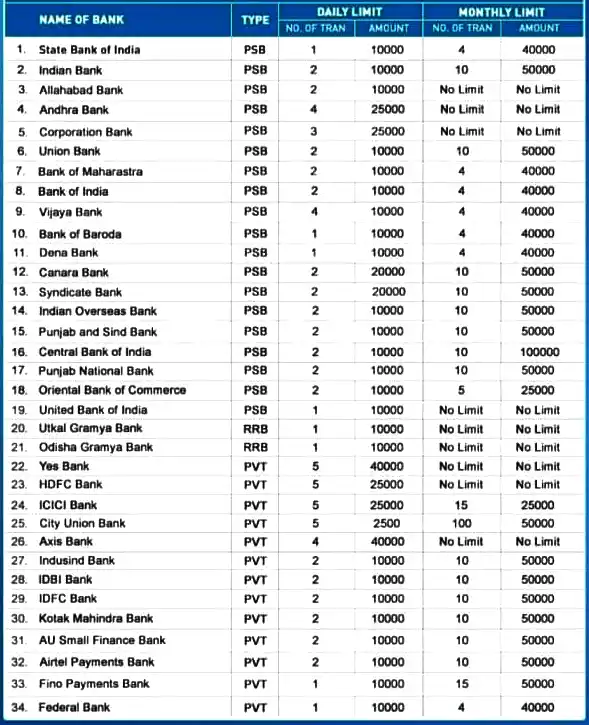

AEPS Transaction Limit Per Day 2022

There most of the banks have set an AEPS Transaction Limit. The AEPS Transaction Limit is set on a day and by Month basis. Below is the list of AEPS Enable Bank Name and their Daily and Monthly AEPS Transaction Limit.

FAQs

How to Check DigiPay Commission?

Go to DigiPay Dashboard and click on passbook. Check the Remarks on the Transaction List. You will find “COMM” with the Date. Check the Row on the Transaction Amount. This is your DigiPay Commission on that Day.

How to Contact DigiPay Technical Support?

For Any DigiPay Installation or Transaction Related issue, you can raise a ticket at https://digipay.csccloud.in/ or call 14599 Toll-Free Number.

How to raise a Ticket for DigiPay Transaction?

Visit https://digipay.csccloud.in/

Click on the ‘Support’ tab

Click on ‘Raise a Ticket

Fill out the questionnaire according to the issue you’re facing.

How to check DigiPay Ticket Status?

Visit https://digipay.csccloud.in/

Click on the “Support tab”

Click on “Check Ticket status”

Provide ‘Ticket ID’ and enter the ‘Captcha’.

Submit to find the status of your ticket.

What is the AePS Maximum Withdraw limit per transaction?

The maximum cash that can be withdrawn using Aadhar AePS is ₹ 10,000 per transaction. AePS transactions are limited by the customer Bank.

Can I Withdraw money even after AEPS Cash withdrawal if Full?

Yes, you can withdraw money even after the AEPS Cash withdrawal limit exists using Aadhaar Pay.