Download AEPS Transaction Register Book: Keep Transparent Financial Records

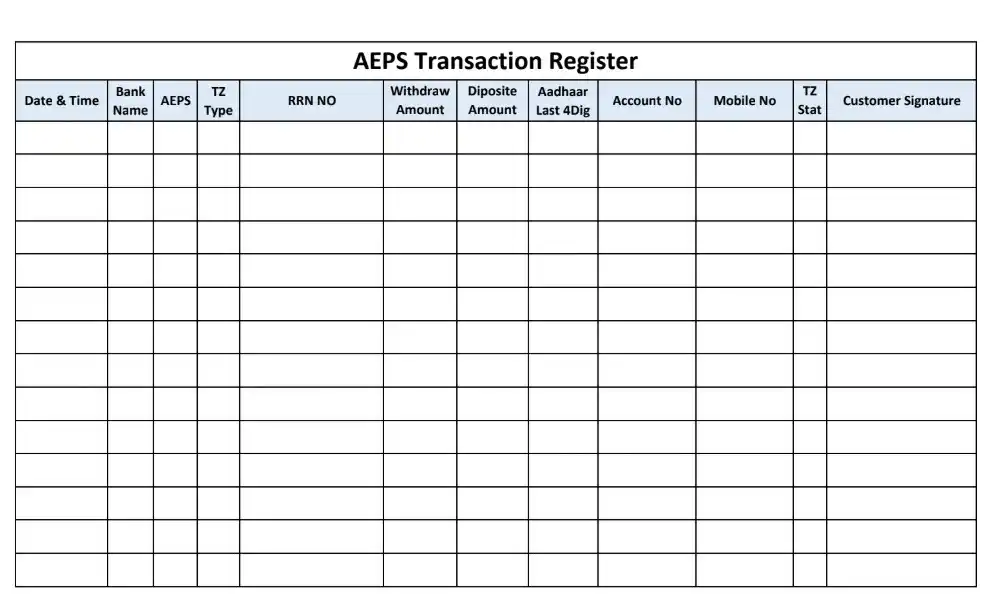

If you are doing an AEPS Transaction, then it is Mandatory to keep a record for future reference or Evidence. For that, You Must Need a Proper Transaction Register Format and An AEPS Register book to keep the records. There I Have made a Transaction Register for that, Simply which will you can download and print and make a Register Book.

What is the AEPS Register Book?

The AEPS Register Book is a simple and user-friendly ledger designed to record and track AEPS (Aadhaar Enabled Payment System) transactions. This book is typically used by CSC VLE, AEPS businesses, or financial institutions to maintain a clear and organized record of financial activities carried out through the AEPS system.

AEPS Register Book Format

How to Maintain AEPS Transaction Register PDF?

Date & Time – Enter the Date and Time of the Transaction.

Customer Name – Write the Customer Name.

Bank Name – Write the Customer’s Bank Name.

Transaction Type – Write which type of Transaction the customer has done, Cash Withdrawal, Cash deposit, MATM, or DMT.

RRN Number – Write the 12-digit RRN Number of each Transaction.

Withdrawal Amount – Write the Aadhaar or MATM Cash Withdrawal Amount.

Deposit Amount – Write the Deposit Amount.

DMT Amount – Write the amount of Domestic Money Transfer(DMT) Amount.

Last Balance – Write the Last Balance which remains on the customer’s account after the Transaction done.

Aadhaar or Debit Card Last 4 Digit – Write Aadhaar or Debit Card Last 4 Digit to Identify the proper Customer.

Mobile Number – Write the Mobile Number of the customer for any further communication.

Transaction Status – Write the Status of the Transaction. If it is a success then put a right tick and for fail put a cross..

Customer Sign / Thumb Impression – Take a Sign / Thumb Impression of the customer for their consent..

Note: Always keep the register confidential from others except you and the customer. Remember anyone can misuse the customer details, it could be up to you.

Do I Keep Failure Transaction Records in the AEPS Register?

Yes, it is necessary and good practice to keep Failure Transaction Records in the Register Book as evidence. In my experience that record can be most important after the Fail Transaction Amount Refund date is over. For Online Complaint in Bank or NPCI, the RRN number or Transaction Number and Transaction amount details are necessary. To track the Transaction kees a Record in the AEPS Register is so Important.

How to Raise a Complaint on Bank for Fail Transaction – Check Now

Why AEPS Transaction Register is so Important?

If you have done a transaction with a customer and given him the amount for which he asked for a withdrawal, But after a week he came to you and claimed that asked amount you had not given him or that you had withdrawn the extra amount that he asked for. In that case, you will be in trouble because there are no transaction records. In that case, a Transaction Register will help you a lot.

Benefits of an AEPS Transaction Register

- Transaction Date and Time

- Transaction Amount

- Transaction Status

- Transaction Realtime Balance

- Transaction Number for Failed Case

- Customer Cencent for Transaction

- Customer Cencent for Handover of the Withdrawal Amount

How to Make AEPS Transaction Register

AEPS Register Book Do’s and Don’t

Do’s

- Maintain a record (offline) of day-to-day transactions in a register.

- For each transaction, you should take the customer’s signature/thumb in the register.

- The biometric device should be clean at the time of capturing the customer’s fingerprint.

- Must provide a Successful or Decline transaction printout to the customer

- In case a transaction is Declined and the Amount is deducted from the customer’s bank account and not credited customer’s account within 3 working days, then raise a complaint at the customer’s bank branch by writing or online.

Dont’s

- No extra charges will be imposed on the customer for any type of transaction

- Don’t process any transaction without customer consent

- Don’t process multiple transactions of the same customer

- Don’t hand over the cash to customers any failed transaction for Cash withdrawal

AEPS Transaction Notice for Customer

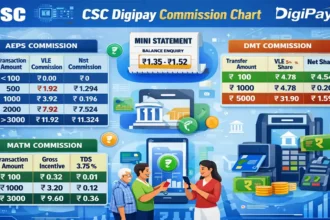

Download CSC DigiPay v7.0 Windows Version – Click Here

AEPS Transaction Register Format Download Links

AEPS Register Book Format Download

| CSC DigiPay AEPS Register | CSC DigiPay LITE AEPS Register | Official Format |

| AEPS Transaction Register Format, Cash Transaction Register pdf download | PDF Format |

| AEPS Transaction Register Format | Excel Format |

You can buy a Bank Transaction Register Online

[content-egg module=AmazonNoApi template=list_no_price]

FAQs

What is an AEPS transaction register?

An AEPS transaction register is a record of all transactions made through the AEPS system. It typically includes the date, amount, and type of transaction, as well as the UID number of the customer and other relevant details.

Why is an AEPS transaction register important?

The AEPS transaction register is an essential record for tracking and managing the financial transactions made through the AEPS system. It can be used for various purposes, such as tracking failed transactions, Statements, and the last balance after withdrawal detection.

Is a Transaction Register essential for AEPS Banking?

Yes, it is mandatory to manage an AEPS Transaction Register to keep the transaction details as evidence in the future.

Who maintains the AEPS transaction register?

The AEPS transaction register is typically maintained by the bank or financial Service provider that provides the AEPS service.

Is the AEPS transaction register available to the public?

The AEPS transaction register is not typically available to the general public. It is a confidential record that is only accessible to authorized personnel, such as bank employees and regulators.

Can customers view their transactions in the AEPS transaction register?

In most cases, customers will not have direct access to the AEPS transaction register. However, they can request a copy of their transaction history from their bank or financial Service provider.