How to Link Aadhaar Number with Bank Account Online: A Step-by-Step Guide

In today’s digital age, linking your Aadhaar number with your bank account is a crucial step to streamline government benefits, financial transactions, and security measures. If you’re wondering how to do it effortlessly, we’ve got you covered. Follow this comprehensive guide to seamlessly Link Aadhaar Number with Bank Account Online.

About Link Aadhaar Number with Bank Account

The process of Link Aadhaar Number with Bank Account Online is made simple by the National Payments Corporation of India (NPCI). This ensures secure and efficient transfer of government benefits and services directly to your account. Let’s explore the step-by-step methods to achieve this.

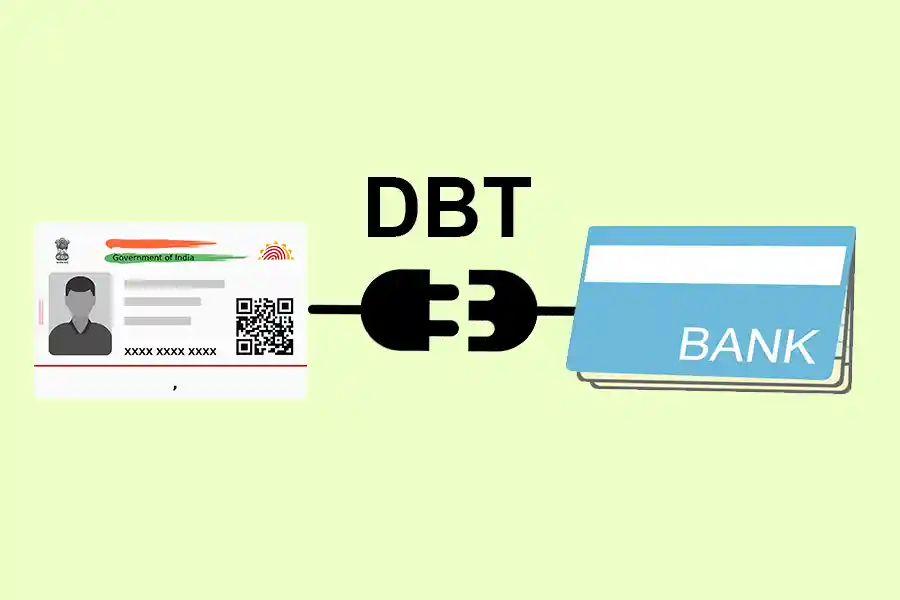

Aadhaar linking with bank account is a mandatory requirement for receiving benefits under various government schemes under the Direct Benefit Transfer (DBT) program. The government introduced DBT to eliminate corruption and ensure that benefits reach the intended beneficiaries directly.

How to Check Your Aadhaar Number Link with Account?

- Visit UIDAI Website:

- Open your web browser and go to the official UIDAI website.

- Navigate to My Aadhaar Services:

- Look for the “My Aadhaar” section on the website’s menu or homepage.

- Choose Check Aadhaar/Bank Seeding Status:

- Click on “Aadhaar Services” and find the option “Check Aadhaar/Bank Seeding Status.”

- Enter Your Aadhaar Number:

- Input your 12-digit Aadhaar number in the designated field.

- Verify OTP:

- You will receive a One-Time Password (OTP) on your registered mobile number. Enter this OTP in the provided space.

- Check Link Status:

- After entering the OTP, click on the “Submit” button.

- The system will display the status of whether your Aadhaar number is linked with your bank account.

If you getting Your Aadhaar and Bank Account Linking Status In-active then you have to follow the below process of How to Link Aadhaar Number with Bank Account Online

How to Link Aadhaar Number with Bank Account Online?

Linking Aadhaar Number through NPCI Website

- Visit the NPCI Website: Start by visiting the official NPCI website: https://www.npci.org.in/.

- Click on “Aadhaar Link” Tab: Locate the “Aadhaar Link” tab on the website’s homepage.

- Enter Details: Provide your Aadhaar number and bank account number in the designated fields.

- Enter OTP: An OTP will be sent to your registered mobile number. Enter this OTP in the provided field.

- Submit: Click on the “Submit” button to finalize the process.

- Confirmation: Once completed, your Aadhaar number will be successfully linked to your bank account.

Linking Aadhaar Number through Bank’s Website or Mobile App

Banks often offer the convenience of linking Aadhaar through their own platforms. The steps may vary, but generally include:

- Log In: Log in to your bank account through their website or mobile app.

- Locate Aadhaar Linking: Find the section related to Aadhaar linking or seeding.

- Enter Details: Provide your Aadhaar number, bank account number, and any other required information.

- OTP Verification: Verify the process by entering the OTP sent to your registered mobile number.

- Submit: Click on “Submit” to complete the linking process.

Linking Aadhaar Number through Self Service Kiosk

- Visit Bank’s Kiosk: Visit your bank’s Self Service Kiosk available at select branches.

- Insert Cards: Insert your Aadhaar card and bank card into the kiosk.

- Follow Instructions: Follow the on-screen instructions to link your Aadhaar number.

Linking Aadhaar Number through Customer Care Executive

- Visit Bank Branch: Go to your bank’s branch.

- Meet Customer Care: Speak to a Customer Care Executive about linking your Aadhaar number.

- Assistance: The Executive will guide you through the process and help link your Aadhaar number.

Benefits of Linking Aadhaar Number with Bank Account

- Direct Benefit Transfers (DBTs): Receive government benefits directly into your Aadhaar-linked bank account.

- Financial Services: Open savings accounts or fixed deposit accounts linked to your Aadhaar.

- Convenient Transactions: Make online payments seamlessly through your Aadhaar-linked bank account.

- ATM Withdrawals: Easily withdraw cash from ATMs using your Aadhaar-linked account.

- Saves time and hassle: Linking your Aadhaar number with your bank account for DBT saves you time and hassle, as you will not have to submit multiple documents to avail of benefits.

- Increases transparency: DBT increases transparency in the delivery of government benefits.

- Eliminates corruption: DBT eliminates the need for middlemen, which helps to reduce corruption.

Aadhaar Seeding with Bank Account

Aadhaar seeding is a crucial process that associates your Aadhaar number with your bank account. This safeguards your financial interests and ensures accurate benefit transfers.

When you link your Aadhaar number with your bank account, the government can verify your identity and address accurately. This helps to prevent fraud and ensure that benefits are not diverted to ineligible beneficiaries.

Once your Aadhaar number is linked with your bank account, you will be able to receive benefits under various government schemes directly into your bank account. This will save you time and hassle, and you will be sure that your benefits reach you without any delay.

How to Check Check Aadhaar Bank Seeding Status?

Ways to Check Aadhaar Bank Seeding Status:

- NPCI Aadhar link bank account status check:

- Visit https://www.npci.org.in/.

- Click on the “Aadhaar Seeding Status” tab.

- Enter your details to check the status.

- Through DBT Website:

- Visit https://dbtbharat.gov.in/.

- Click “Documents,” then go to Aadhaar/UIDAI > Citizen Corner > Citizen’s Bank Account-Aadhaar linking status.

- You’ll be redirected to the UIDAI Portal.

- Enter your Aadhaar number and verify OTP to check the link status.

- Bank’s Website or App:

- Log in to your bank account through their platform.

- Check the seeding status in your account settings.

- Self Service Kiosk:

- Visit your bank’s Self-Service Kiosk.

- Follow the instructions on the screen to check the seeding status.

- Customer Care:

- Contact your bank’s Customer Care for assistance in checking the seeding status.

Final Talk

Link Aadhaar Number with Bank Account Online is a fundamental step in today’s digital landscape. It ensures the secure flow of government benefits and financial transactions. Whether you choose the NPCI website, your bank’s platform, or other options, this guide has provided you with a comprehensive roadmap to follow.

FAQs

Why should I link my Aadhaar number with my bank account?

Link Aadhaar Number with Bank Account Online enables seamless government benefit transfers, online payments, and ATM withdrawals.

How can I link my Aadhaar number with my bank account online?

Visit the NPCI website, enter your Aadhaar and bank account details, and submit the OTP sent to your mobile number.

What is NPCI, and why do I need to visit its website?

NPCI (National Payments Corporation of India) is responsible for Aadhaar linking. Visit their website to link your Aadhaar and bank account.

Can I check the status of my Aadhaar linking?

Yes, you can check the status on the NPCI website using your Aadhaar and bank account details.

What should I do if my Aadhaar linking request is rejected?

Contact your bank to know the reason for rejection and address it. You can then reapply for linking.

Are there benefits to linking Aadhaar with my bank account?

Yes, benefits include direct government benefit transfers, easy online transactions, and access to various banking services.

Can I link my Aadhaar with my bank account offline?

Yes, visit your bank branch with Aadhaar card, bank passbook, ID, and utility bill to link offline.

How do I check my Aadhaar bank seeding status?

Visit the NPCI website, use your bank’s website or app, self-service kiosk, or contact your bank’s Customer Care.

What does “Aadhaar seeding” mean?

Aadhaar seeding is linking your Aadhaar number with your bank account for secure transactions and government benefits.

Is linking Aadhaar with bank account mandatory?

While it’s not mandatory, linking Aadhaar with your bank account offers various conveniences and benefits.