Airtel Payment Bank Retailer Login – Convenient Banking Services

Airtel Payment Bank Retailer Login is a platform that allows retailers to become BC agents and banking service providers to customers. These retailers offer various banking services such as account opening, cash withdrawal, deposits, money transfers, bill payments, gas booking, and more. They play a crucial role in providing banking services to citizens who may not have access to traditional banks or online payment methods. Airtel Payment Bank retailers operate from their nearest retail point, making banking services easily accessible to customers in remote areas.

In this article, we will explore the role of Airtel Payment Bank retailers, the services they provide, and the advantages and disadvantages of using the Airtel Payment Bank Retailer Login on the AirtelTez Portal and Mitra App. We will also compare AirtelTez Portal and Mitra App to determine which is more convenient. Additionally, we will discuss some good practices for Airtel Payment Bank Retailer Login and highlight the most profitable services offered by Airtel Payment Bank.

Who are Airtel Payment Bank Retailers?

Airtel Payment Bank Retailer is a BC agent cum Banking Service provider who provided general Banking solutions like Account Opening, Cash Withdrawal, Deposit, Money Transfer, Bill Payment, Gas Booking, and much more by Airtel Payment Bank Retailer Login.

[hurrytimer id=”3186″]

The Role of the Airtel Payment Bank Retailer

The role of Airtel Payment Bank retailers is crucial in bridging the gap between customers and Airtel Payment Bank services. These retailers act as points of contact for customers, providing general banking, facilitating money transfers, mobile recharges, bill payments, and other services offered by Airtel Payment Bank. They also earn commissions on the transactions made through their retailer accounts.

How to Become an Airtel Payment Bank BC

Which Service Does Airtel Payment Bank Retailer Provide

Airtel Payment Bank retailers offer a wide range of services to their customers, which may vary depending on the platform they use for login, either AirtelTez Portal or Mitra App. Some of the common services provided by Airtel Payment Bank retailers:

- Account Opening

- Money Transfer

- Cash Withdrawal

- Cash Drop

- Cash Deposit

- Link / Dlink Aadhaar for DBT

- Aadhaar Enabled Payment System(AEPS)

- Mobile, DTH Recharges

- Utility Payments-BBPS Electricity, Gas, Water, Insurance Premium Bill Payment

- FASTag

- Refer for Lone

- Health Insurance

- General Insurance

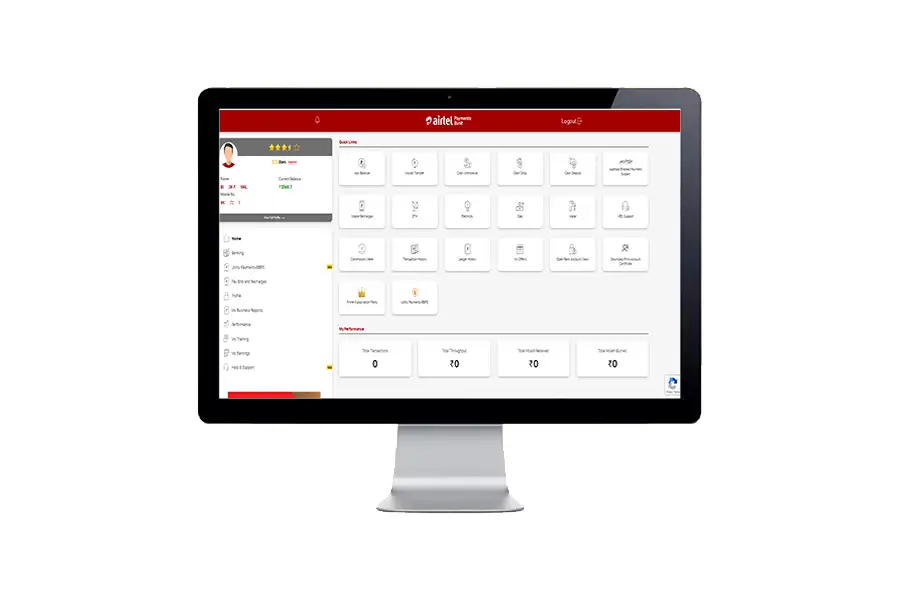

Airtel Payment Bank Retailer Login on AirtelTez Portal

Tez Portal is a platform provided by Airtel Payment Bank that allows retailers to access their accounts and manage transactions by Airtel Payment Bank Retailer Login on AirtelTez Portal. Follow the steps for Airtel Payment Bank Retailer Login on AirtelTez Portal:

- Visit Airtel Payment Bank Retailer Portal https://portal.airtelbank.com/RetailerPortal/

- Enter Your Mobile Number and Password

- Now Enroll your device as a New Trusted Device using OTP Verification

- After successful OTP Verification, you can Airtel Payment Bank Retailer Login

- Again Enter Your Mobile Number and Password and Click on Login

- After successful Airtel Retailer Login, you can access the AirtelTez Portal Dashboard

Advantages and Disadvantages Airtel Payment Bank Retailer Login on AirtelTez Portal

| Advantages | Disadvantages |

|---|---|

| User-friendly interface for easy navigation and transaction management. | Limited availability of services compared to Mitra Application. |

| Access to a wide range of services, including money transfers, bill payments, and mobile recharges. | High-Speed Internet connectivity is needed for accessing the TEZ portal. |

| Large View and Clear View | Sometimes technical glitches or issues with the portal appear. |

| Detailed transaction history and reports for better tracking and management. | Biometric Setup on a PC is a little more complicated than on a Mobile. |

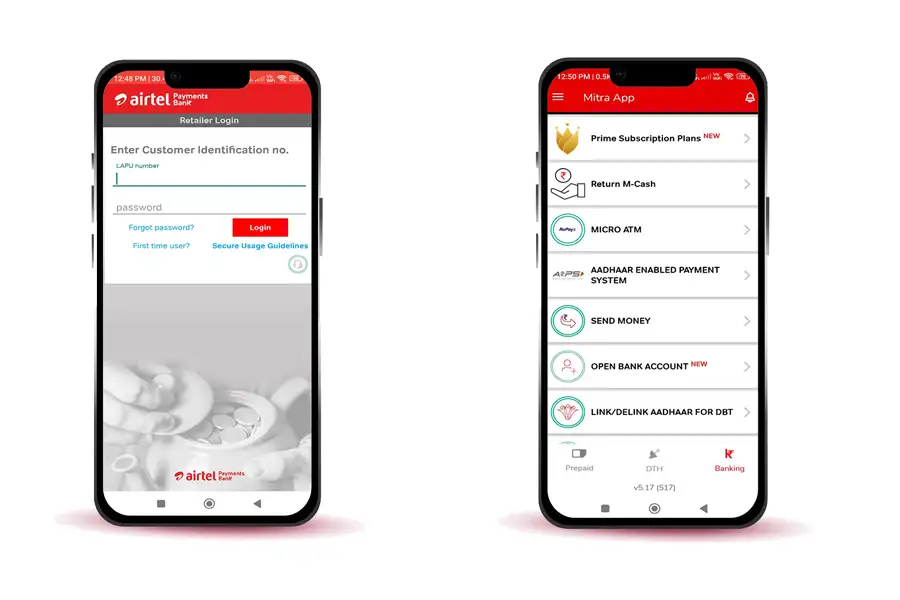

Airtel Payment Bank Retailer Login on Mitra App

Mitra App is a mobile application provided by Airtel Payment Bank that allows retailers to access their accounts and manage transactions on their smartphones by Airtel Payment Bank Retailer Login. Follow the steps for Airtel Payment Bank Retailer Login on Mitra Application:

- Download Mitra Application From Google Play Store

- Install and Open Airtel Mitra Application

- Click on Login with Airtel Payment Bank

- Enter Your Mobile Number and Password

- Now Enroll your device as a New Trusted Device using OTP Verification

- After successful OTP Verification, you can Airtel Payment Bank Retailer Login

- Again Enter Your Mobile Number and Password and Click on Login

- After successful Airtel Retailer Login, you can access the Mitra Airtel Payment Bank Retailer Dashboard

Advantages and Disadvantages Airtel Payment Bank Retailer Login on Mitra App

| Advantages | Disadvantages |

|---|---|

| The convenience of accessing the retailer account and managing transactions on a mobile device from anywhere. | Dependence on a mobile device and internet connectivity for accessing the app. |

| Availability of All services, which are available for Airtel Payment Bank Retailer. | Limited screen size and functionality compared to a computer or laptop. |

| Quick and convenient transactions on-the-go, without the need for a computer or laptop. | Potential issues with app updates and compatibility with different mobile devices. |

| Real-time transaction updates and notifications for better tracking and management. | May be facing an Inturaption by Incoming Calls during Working. |

| Availability of offline mode for limited connectivity areas. |

AirtelTez Portal and Mitra App Compare, which is more Convenient?

Both AirtelTez Portal and Mitra App are platforms provided by Airtel Payment Bank for retailer login, and each has its advantages and disadvantages. The convenience of using either platform depends on the preferences and requirements of the retailer.

AirtelTez Portal provides a user-friendly interface with detailed transaction history and reports, while Mitra App offers the convenience of on-the-go transactions with real-time updates. Retailers who prefer using a computer or laptop may find AirtelTez Portal more convenient, while those who prefer using a mobile device may find Mitra App more convenient.

Some Good Practices on Airtel Payment Bank Retailer Login

When using Airtel Payment Bank Retailer Login, it is important to follow some good practices to ensure smooth transactions and secure account management. Some of the good practices are:

- Keeping the retailer account credentials confidential and not sharing them with anyone.

- Regularly updating the password and other security details of the retailer account.

- Verifying the transaction details before confirming any transaction.

- Keeping the retailer app or portal updated to the latest version for enhanced security features.

- Keeping updated with the latest version of biometric device

- Use a Fast Internet Connection

- For Any Falure Transaction Contact Support and raise a Complain and keep tracking the Status

- Keep a Physical Record of all of the transactions you daily perform

- AEPS cash withdrawal Must keep a record with the customer’s Signature or Thumb Impression

- Only Hand Over the Cash if you confirm the transaction is successful and credited to your Wallet

- Don’t overcharge the customer for any services you provided which are against the law

- Provide a transaction receipt to the customer if possible

- Contacting Airtel Payment Bank customer support for any assistance or queries.

Airtel Payment Bank’s Most Profitable Services for Retailers

Airtel Payment Bank offers various services that can be profitable for retailers. Some of the most profitable services offered by Airtel Payment Bank:

- Money transfer services, as retailers can earn commissions on each transaction.

- Offering banking services to customers, such as opening savings accounts, fixed deposits, etc., which can earn retailers commissions or incentives.

- Providing financial services, such as insurance and loans, to customers, can generate additional income for retailers.

FAQs

How can I become an Airtel Payment Bank retailer?

You can become an Airtel Payment Bank retailer by registering on the official Airtel Payment Bank website or through the Mitra App.

What services can I offer as an Airtel Payment Bank retailer?

As an Airtel Payment Bank retailer, you can offer services such as money transfer, mobile recharge, bill payment, and other digital banking and financial services to your customers.

How can I access Airtel Payment Bank Retailer Login?

Airtel Payment Bank Retailer Login can be accessed through the AirtelTez Portal or the Mitra App, depending on the preferred platform chosen by the retailer.

What are the advantages of using Airtel Payment Bank Retailer Login?

The advantages of using Airtel Payment Bank Retailer Login are access to various services with a Reliable Commission for Earn Money.