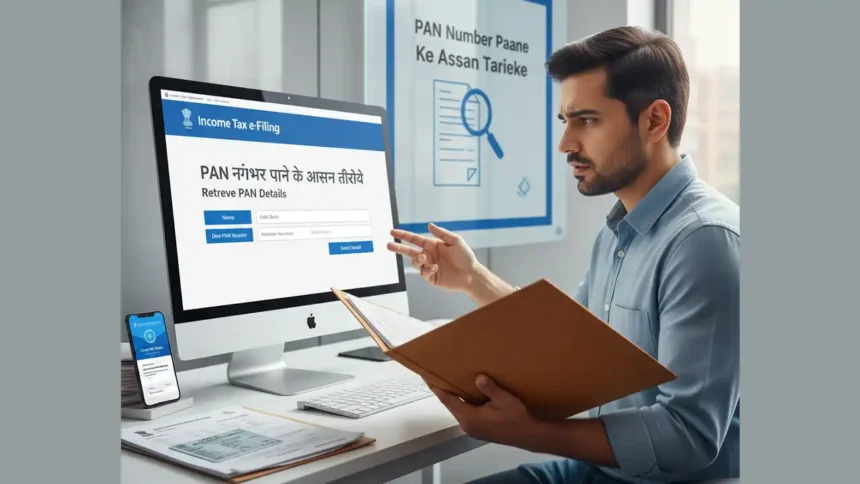

Bhool Gaye Apna PAN Number? Kaise Milega Dubara Sirf 2 Minute Mein!

Aapka wallet kho gaya ya PAN card kahin mil nahi raha? Ghabraiye mat! Aaj ke digital yug me apna lost PAN Card Number ya forgot PAN card number wapas paana bahut hi aasan ho gaya hai. Income Tax Department ne aise kai suvidhaayein di hain jisse aap ghar baithe apna PAN number dobara prapt kar sakte hain. PAN (Permanent Account Number) aaj ek zaroori identity proof ban chuka hai — bank, property, ITR filing aur bade transactions sab ke liye iski zarurat hoti hai.

Agar aap apna PAN card kho chuke hain aur number yaad nahi, toh naye PAN ke liye apply karne ki koi zarurat nahi. Aap apna purana PAN number aasani se dobara nikal sakte hain.

PAN Number Itna Zaroori Kyu Hai?

PAN aapke liye ek unique financial identity hai. Ye Income Tax Department ke database me aapke sabhi financial transactions ko track karta hai.

- ITR file karne ke liye zaruri

- Bank aur Demat account kholne me mandatory

- ₹50,000 se zyada ke cash deposit/withdrawal ke liye zaruri

- Mutual fund, share, aur bond investments ke liye required

- 5 lakh se zyada ki property kharid-bech me mandatory

- Ek valid photo ID proof ke roop me bhi kaam karta hai

Lost PAN Card Number Pata Karne Ke 5 Aasan Tarike

Method 1: Income Tax e-Filing Portal se PAN Number Pata Karein

Yeh sabse tez aur asaan tareeka hai. Isme aapko Aadhaar aur mobile number ki zarurat hoti hai.

Step-by-Step Process:

- Visit https://www.incometax.gov.in/iec/foportal/

- Homepage par “Quick Links” me “Instant E-PAN” par click karein.

- “Check Status / Download PAN” option chunein aur “Continue” par click karein.

- Apna 12-digit Aadhaar number daalein aur OTP verify karein.

- Agar PAN aur Aadhaar linked hai, toh screen par aapka PAN number dikh jaayega.

- Chahein toh e-PAN download bhi kar sakte hain.

Note: Is process me koi charge nahi hai, aur pura kaam 2-5 minute me ho jaata hai.

Method 2: Purane Documents aur Records Check Karein

Agar online system me dikkat aa rahi hai, toh apne purane documents check karein.

Kahan Check Karein:

- ITR-V Copy: Income Tax Return acknowledgment me PAN likha hota hai.

- Form 26AS: Net banking ke zariye check karein.

- Salary Slip / Form 16: Company dwara diye gaye documents me PAN mention hota hai.

- Bank Statements: Bank Statement mai vi PAN details Mill sakta hai.

- Investment Papers: Mutual fund, insurance, ya shares ke documents me PAN likha hota hai.

- Email Inbox: “PAN”, “NSDL”, “UTIITSL”, “Income Tax” se search karein.

- DigiLocker: Agar PAN upload hai, toh wahan mil jaayega.

- Bank Visit: Branch me jaake relationship manager se pooch sakte hain.

Method 3: NSDL/UTIITSL Portal se Reprint PAN

Agar PAN number mil gaya hai, lekin card kho gaya hai, toh aap duplicate card mangwa sakte hain.

Process:

- Pata karein ki PAN kis portal se bana tha — NSDL ya UTIITSL.

- Visit karein:

- “Reprint of PAN Card” option chunein aur apna PAN, DOB, Aadhaar daalein.

- ₹50 ki online fee pay karein.

- 10–15 working days me naya card aapke address par aayega.

Method 4: Income Tax Helpline par Call Karein

Agar aap online methods me comfortable nahi hain, toh Income Tax Department ke helpline number par call karein.

Toll-Free Number: 1800 180 1961

Call karne se pehle apni details taiyar rakhein:

- Poora naam

- Pita ka naam

- Janm tithi (DOB)

- Address

- Aadhaar number (agar ho)

Executive aapse verification karke aapka PAN number batayenge.

Method 5: e-PAN Download Karein

Jab PAN number mil jaaye, toh apna e-PAN download karein.

- Yeh digitally signed PDF version hota hai.

- Physical card ke barabar valid hai.

- Income Tax portal, NSDL, ya UTIITSL website se download kiya ja sakta hai.

- Naya PAN recent hai toh free, purana hai toh nominal fee lag sakti hai.

Apna PAN Number Milne ke Baad Kya Karein?

- DigiLocker me Save Karein: Original ke barabar valid hai.

- PAN ki Photo Phone me Save Karein

- Google Drive ya Dropbox me Backup Rakhein

- Apne Aapko Email Karein

- Diary me Likhkar Rakhein

Security Tips

- PAN kisi anjaan vyakti ke saath share na karein.

- Sirf official websites (incometax.gov.in, nsdl, utiitsl) ka hi use karein.

- Fake sites se bachein jo “Know Your PAN” ke naam par data maangti hain.

- Agar card kho gaya hai, toh police FIR karwa lein.

Conclusion

PAN card number kho jaana ek pareshani jarur hai, par iska hal aasan hai. Aap Income Tax portal, purane documents, ya helpline number ke zariye apna PAN number aasani se wapas paa sakte hain. Naye PAN ke liye apply karne ki zarurat nahi.

Aaj ke digital yug me, bas 5 minute me aap apna PAN number dobara paa sakte hain — bina kisi agent, office visit, ya extra kharche ke. Bas sahi jaankari aur official process follow karein, aur aapka kaam turant ho jaayega.

Lost PAN Card Number (FAQs)

Q1. Mera PAN aur mobile dono kho gaye hain, kya karun?

A1. Aap purane documents check karein ya Income Tax helpline (1800 180 1961) par call karein.

Q2. Kya sirf naam se PAN number mil sakta hai?

A2. Nahi, aapko DOB aur Aadhaar/OTP verification deni hoti hai.

Q3. Duplicate PAN card aane me kitna time lagta hai?

A3. 10–15 working days me naya card mil jaata hai.

Q4. Kya e-PAN valid hai?

A4. Haan, e-PAN har jagah valid hai.

Q5. PAN number recover karne me koi charge lagta hai?

A5. Nahi, Income Tax portal par yeh service bilkul free hai.