How to Fix AEPS Debit Facility Disabled in Indian Bank

The AEPS (Aadhaar Enabled Payment System) is an important banking service in India. It helps millions of people, especially in rural and remote areas, to access basic banking features with just their Aadhaar number and biometric (fingerprint). You can use AEPS at micro-ATMs and banking correspondents (BCs) for activities like cash withdrawal, balance check, and fund transfer — even without debit cards or internet connectivity.

However, many Indian Bank customers have recently faced the message:

📌 “AEPS debit facility disabled.”

In this guide, we will explain:

✅ What this message means

✅ Why AEPS debit gets disabled

✅ New 2025–2026 NPCI & RBI guidelines

✅ The impact on users

✅ How to get the AEPS debit facility reactivated

1. What Is AEPS Debit Facility?

AEPS debit means you can use your Aadhaar number + biometric authentication to:

✔ Withdraw cash

✔ Check your account balance

✔ Transfer funds

✔ Perform other AEPS transactions

This system is especially useful in areas with few ATMs or banks. It simplifies banking and promotes financial inclusion.

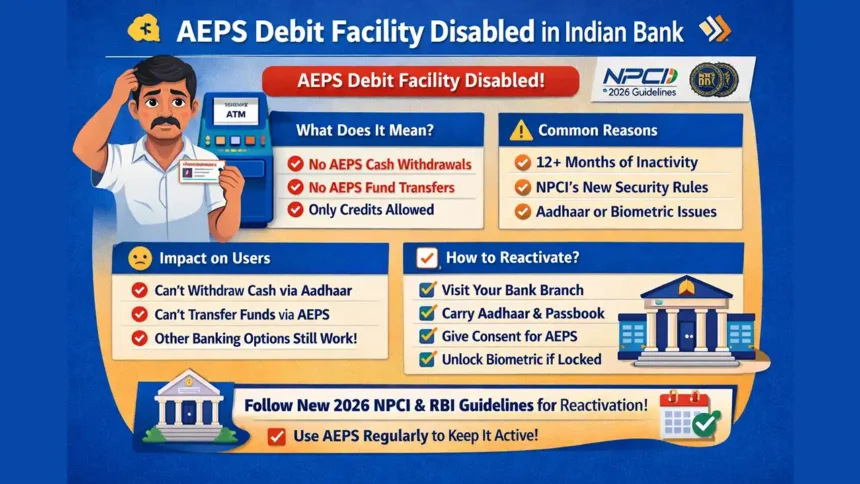

2. What Does “AEPS Debit Facility Disabled” Mean?

When you see the message “AEPS debit facility disabled”, it means:

❌ You cannot do AEPS cash withdrawals

❌ You cannot perform AEPS-based fund transfers

❌ AEPS debit transactions are temporarily blocked

But:

✅ You can still receive money using AEPS

✅ Your bank account is not frozen

✅ Other services like debit card, net banking, mobile banking still work

So, only the AEPS debit side is blocked, not your entire account.

3. Why Is AEPS Debit Facility Disabled?

There are several reasons why the AEPS debit facility may be blocked, especially in Indian Bank:

a. Inactivity

If you haven’t used AEPS for 12+ months, the system may auto-disable the debit feature as a security measure.

b. NPCI’s Security Guidelines

NPCI (National Payments Corporation of India) has instructed banks to:

🔹 Disable AEPS for accounts with zero AEPS debit activity in 12 months

🔹 Disable AEPS if the only transaction in the last year was reported as fraud

🔹 Seek explicit consent from customers before enabling AEPS debit

🔹 Give customers the option to enable/disable AEPS debit via branch, mobile app, or call centre.

These steps are for fraud control and safety, not punishment.

c. Security or Fraud Concerns

If your account shows unusual activity or suspected fraud, banks may temporarily block AEPS to protect you.

d. Aadhaar Linking or Biometric Issues

AEPS requires:

✔ Aadhaar must be linked correctly to your bank account

✔ Biometric authentication must work properly

If either fails repeatedly, AEPS debit may be disabled.

e. Regulatory Directives from RBI

The Reserve Bank of India (RBI) has issued updated rules for AEPS system safety:

📌 RBI now mandates strict monitoring, risk controls, and due-diligence checks for AePS operations starting 1st January 2026.

📌 Banks must monitor transaction patterns, ATO (AePS Touchpoint Operators) activity, and ensure secure authentication.

This is part of a broader safety effort to reduce identity theft and fraudulent AEPS use.

4. Impact on Users

When AEPS debit is disabled:

❌ You cannot withdraw cash using Aadhaar + fingerprint

❌ You cannot transfer money via AEPS debit

✔ You can still use:

✅ Debit cards

✅ Mobile banking

✅ Net banking

✅ Receive funds in your account

This issue mainly affects users who depend primarily on AEPS — especially in rural regions with limited ATMs.

5. Recent 2025–26 NPCI & RBI Guidelines Impacting AEPS

NPCI Guidelines

NPCI has taken steps to make AEPS safer and more secure:

🔹 Banks must block accounts with no AEPS debit use for 12 months

🔹 If only AEPS activity in a year is fraudulent, AEPS must be disabled immediately

🔹 Banks must take explicit consent from customers for enabling AEPS debit

🔹 Customers should be offered simple options to enable or disable AEPS debit through mobile app, branch, or call centre.

RBI’s Enhanced Guidelines (Effective Jan 1, 2026)

RBI has introduced strong regulations for AEPS operations:

👉 Banks must perform complete KYC due diligence on AePS Touchpoint Operators (BCs and Bank Mitras).

👉 ATOs inactive for 3+ months must undergo fresh KYC before resuming activity.

👉 Banks must monitor AePS activity continuously to detect suspicious patterns.

👉 Risk profiling based on transaction volume and location is now required.

These changes are designed to strengthen safety against fraud and protect customer funds.

6. How to Reactivate Your AEPS Debit Facility (Indian Bank)

Step-by-Step Solution

Step 1: Visit Your Indian Bank Branch

Go to your home branch and request AEPS debit reactivation.

Step 2: Bring Required Documents

✔ Aadhaar card

✔ Bank passbook

✔ Any other valid ID (if requested)

Step 3: Fix Aadhaar Biometric Issues (If Any)

If your Aadhaar biometric is locked or blocked, unlock it via the UIDAI website before visiting the bank.

Step 4: Ask for AEPS Consent Activation

According to NPCI rules, the bank may need your explicit consent to enable AEPS debit or Aadhaar Seeding.

Step 5: Perform a Test AEPS Transaction

After activation, do a small AEPS action like balance inquiry to confirm it’s working.

Step 6: Use AEPS Regularly

To prevent automatic disabling again, use AEPS at least once in 2–3 months.

7. Key Points to Remember

✔ “AEPS debit disabled” does **not mean your account is frozen.”

✔ You can still receive money even if AEPS debit is off.

✔ Disabling is usually for security, guideline compliance, or inactivity.

✔ Regular AEPS usage helps keep the service active.

✔ RBI & NPCI have updated rules to improve safety and reduce fraud.

Final Thought

The AEPS debit facility is a vital tool for financial inclusion, particularly for people in rural and underserved areas. Seeing the message “AEPS debit facility disabled” can be worrying, but most of the time it’s due to inactivity, security updates, or compliance with NPCI/RBI guidelines.

Thankfully, this problem is fixable — just visit your bank branch, provide the necessary documents, give consent if required, and use AEPS regularly to avoid future disruptions.

FAQs

1. What does “AEPS debit facility disabled” mean?

It means AEPS cash withdrawal and fund transfer are blocked, but your bank account is still active and can receive money.

2. Is my Indian Bank account frozen if AEPS debit is disabled?

No. Only AEPS debit services are disabled. ATM, debit card, mobile banking, and net banking continue to work.

3. Can I still receive money through AEPS?

Yes. AEPS credit (receiving money) is allowed even when debit is disabled.

4. Why did Indian Bank disable my AEPS debit facility?

Common reasons include 12 months of AEPS inactivity, NPCI security rules, suspected fraud, Aadhaar linking issues, or biometric failures.

5. Does NPCI mandate AEPS debit deactivation?

Yes. As per NPCI guidelines, banks may disable AEPS debit for inactive users or accounts flagged for risk.

6. Are there new RBI rules affecting AEPS in 2026?

Yes. From January 2026, RBI has introduced stricter monitoring, KYC, and fraud-control rules for AEPS transactions.

7. How can I reactivate AEPS debit in Indian Bank?

Visit your home branch with Aadhaar and passbook, give consent for AEPS, and complete biometric verification.

8. Do I need to unlock my Aadhaar biometric?

If your biometric is locked, yes. Unlock it on the UIDAI portal before visiting the bank.

9. How long does AEPS reactivation take?

Usually same day or within a few working days, depending on branch processing.

10. How can I avoid AEPS debit being disabled again?

Use AEPS at least once every 2–3 months to keep the facility active.