How to Use Digipay AEPS Register Book PDF: Quick Guide

Digipay AEPS Register Book PDF is a helpful tool for individuals who use the Aadhaar Enabled Payment System (AEPS) to facilitate financial transactions. AEPS is a government initiative that helps individuals without a bank account to access basic banking services through their Aadhaar number. DigiPay is one such platform that offers AEPS services. The Digipay AEPS Register Book PDF allows users to keep track of their transactions in a convenient way.

What is DigiPay?

DigiPay is a digital payment platform that enables financial transactions through AEPS. It was launched by the CSC SPV with the National Payments Corporation of India (NPCI) and is regulated by the Reserve Bank of India (RBI). The platform is widely used across the country by individuals and businesses to facilitate transactions related to banking, microfinance, and other financial services.

What can you do with Digipay?

You May Love To Read

- Withdraw cash from your bank account using Aadhaar Banking AEPS.

- Check your account balance and Mini Statements.

- Transfer money to other accounts linked to the AEPS network.

Where is it available?

Through CSC centers (Common Service Centres), which are government-run kiosks offering various services, including Digipay.

What is AEPS?

As mentioned earlier, AEPS is an initiative by the Government of India that allows individuals to access basic banking services using their Aadhaar number. This system is useful for individuals who do not have access to a bank account or those who prefer not to use cash for transactions. Some of the services that can be availed through AEPS include balance inquiry, cash deposit, cash withdrawal, and money transfer.

What is Digipay AEPS Register Book PDF?

The Digipay AEPS Register Book PDF is a record-keeping tool that allows individuals to keep track of their transactions on the Digipay platform. It is essentially a register book that records details such as the date of the transaction, the amount transferred, the source of the transaction, and the destination of the transaction. This tool is useful for individuals who need to keep a record of their transactions for personal or business purposes.

Advantages of using Digipay AEPS Register Book PDF:

- Convenient record-keeping: The register book allows users to keep track of their transactions in a convenient way. They can simply record the details of the transaction in the book and refer to it later if needed.

- Better financial management: The register book helps users to manage their finances better by providing a record of their transactions. They can analyze their spending patterns and make informed financial decisions.

- Compliance with regulations: The RBI requires all AEPS transactions to be authorized with the user’s Aadhaar number. The Digipay AEPS Register Book PDF allows users to record these details for compliance purposes.

How to use Digipay AEPS Register Book PDF:

Using the DigiPay AEPS Register Book PDF is a simple process. The user can simply download the Register book from the below Link and print it out. Then start keeping transaction details in the book. It is important to record all the relevant details such as the date of the transaction, the amount transferred, and the source and destination of the transaction.

To keep records on a Digipay AEPS Register Book PDF:

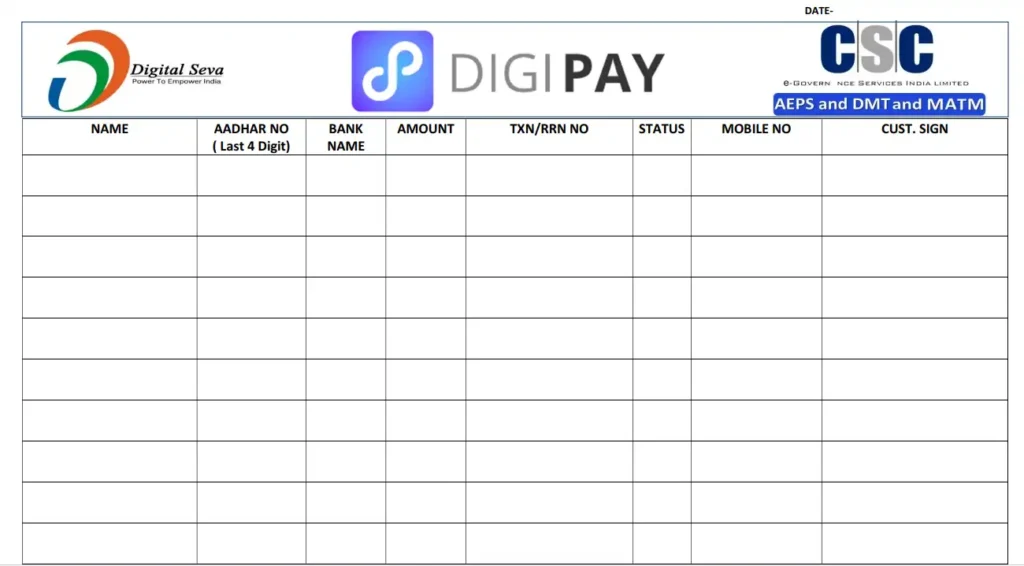

Fill in the following details:

You May Love To Read

- Customer Name: Write the Customer’s full name as per your Aadhaar card.

- Aadhaar Number Last 4 Digits: Enter the last four digits of your Aadhaar number for identification purposes.

- Bank Name: Mention the name of the bank associated with your Aadhaar number.

- Amount: Specify the amount of the transaction.

- TXN/RRN Number: Enter the transaction or reference number provided by Digipay.

- Status: Indicate the status of the transaction (e.g., success, pending, failed).

- Mobile Number: Provide the mobile number linked to your Aadhaar card.

- Customer Sign: Sign the register book to confirm your consent and the authenticity of the recorded transaction details.

Download Digipay AEPS Register Book PDF

Redirect Link Content

Conclusion:

Digipay AEPS Register Book PDF is a useful tool for individuals and businesses who use the Digipay platform for financial transactions. It allows users to keep track of their transactions in a convenient way and helps them to manage their finances more effectively. The RBI requires all AEPS transactions to be authorized with the user’s Aadhaar number, and the register book can be used to comply with these regulations. Overall, the Digipay AEPS Register Book PDF is a simple yet effective tool that can benefit anyone who uses the Digipay platform.