Smooth Travels Ahead: A Guide to FASTag KYC Update Online

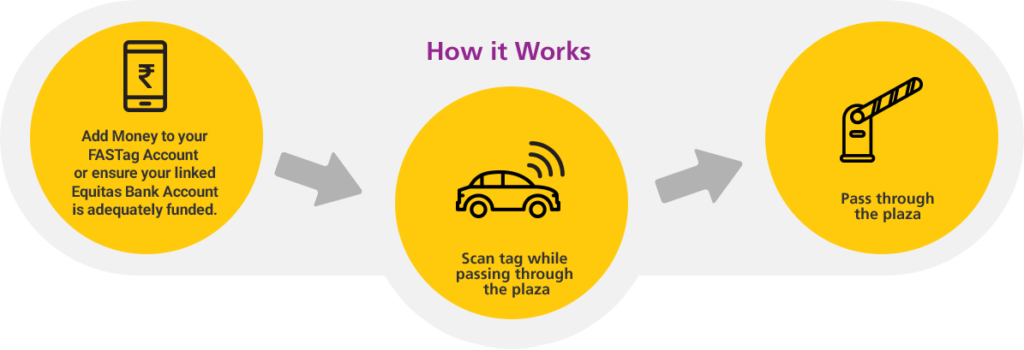

Do you have a car or vehicle? If you use FASTag at toll plazas, you know how easy it is to pay tolls. But here’s the thing: to keep enjoying the smooth ride, make sure your KYC (Know Your Customer) details are up to date. It’s like giving your FASTag a little checkup. FASTag KYC Update Online is super important; it keeps everything safe and secure. Plus, it’s like a special pass to get even more benefits, like higher recharge limits and making sure you don’t accidentally pay tolls twice. So, in this fast-moving world, keeping your KYC details current ensures your FASTag works its magic every time you drive through a toll plaza.

What is FASTag KYC?

FASTag users are required to complete the FASTAG KYC (Know Your Customer) verification process. By verifying the user’s address and identity, it seeks to fortify financial security and stop FASTag misuse. Users can do FASTag KYC Update Online.

Benefits of FASTAG KYC?

- Higher Recharge Limit: Increase your wallet limits for smoother toll payments with FASTag KYC. Note that specific limits may vary depending on the issuer.

- No Double Toll Deduction: Prevent accidental double charges at toll plazas by ensuring that your FASTag and vehicle registration details match. This is a direct benefit of completing FASTag KYC.

- Enhanced Security: Contribute to a more secure FASTag ecosystem by providing verified identification through the KYC process. This adds an extra layer of protection to your FASTag transactions.

Why is FASTag KYC Necessary?

FASTAG KYC is mandated by the Reserve Bank of India (RBI) for the following reasons:

You May Love To Read

- How to Pay Telegram Premium: To Upgrade Communication and Productivity

- Top 10 Best Credit Cards for Rewards Points in India 2024

- Do you think Humane AI Pin Can End the Age of Smartphones?

- Boost CSC Services Center Reach with CSC Banner Designs!

- All Banking Ombudsman Complaint Links for Failed Transaction

1. Strengthening Financial Security

FASTag KYC is not just a bureaucratic formality; it’s a pivotal step in fortifying the financial security of users. Verifying users’ identity and address acts as a deterrent against misuse and unauthorized transactions.

2. Compliance Deadline: February 29, 2024

The clock is ticking! The regulatory deadline for completing the KYC process is February 29, 2024. Non-compliance may result in restrictions or penalties, emphasizing the urgency of this update.

3. Benefits of FASTag KYC

Completing the KYC process brings tangible benefits, including higher recharge limits and enhanced security. It ensures a hassle-free FASTag experience by preventing issues like double toll deductions due to mismatched details.

What Documents are Required for FASTag KYC?

1. Essential Documents

- Vehicle Registration Certificate (RC): Proof of ownership and vehicle details.

- Passport-size photograph: Required by some issuers.

2. ID Proof (Choose one)

- Pan Card: Provides tax identification and financial information.

- Aadhaar Card: Multi-purpose identity document issued by UIDAI.

- Driving License: Government-issued ID with address and photo verification.

- Voter’s ID Card: Issued by the Election Commission of India.

3. Address Proof (Choose one if not using Aadhaar Card)

- Aadhaar Card (If address details are updated)

- Utility bills (electricity, water, telephone): Not older than 3 months, in the user’s name.

- Bank statements: Not older than 3 months, with the user’s address printed.

- Passport: Valid passport containing the user’s address.

4. General Reminders

- Keep documents ready (ID, address proof, vehicle RC)

- Ensure clarity and legibility of documents

- Self-attest documents (sign and date)

- Double-check issuer-specific requirements

- Monitor KYC status after submission

- Contact issuer’s customer care for any issues

Step-by-Step Guide for FASTag KYC Update Online

1. SBI FASTag KYC Update Online

- Visit SBI FASTag Portal

- Login using your registered mobile number and password

- Navigate to “My Profile” and check KYC status

- If KYC is pending, click “KYC” tab and provide required documents

- Submit and complete verification

2. FASTag KYC Login (IHMCL Portal)

- Access IHMCL Portal

- Login with your mobile number and password/OTP

- Navigate to “My Profile”

- Check KYC status and update if pending (refer to SBI steps)

3. Paytm FASTag KYC Update Online

- Open Paytm app

- Select “FASTag” under “Recharge & Pay Bills”

- Click “Manage FASTag”

- Choose “Update KYC” and upload required documents

Other Issuers FASTag KYC Update Online

HDFC FASTag KYC Update Online:

To update your HDFC FASTag KYC online, use the HDFC mobile banking app or website. Log in to your account, navigate to the FASTag section, and look for the “KYC Update” option. Provide the necessary details and documents for a seamless update.

ICICI FASTag KYC Update Online:

Updating your ICICI FASTag KYC is easy. Access the ICICI mobile banking app or website, log in, and go to the FASTag section. Look for the “KYC Update” option, where you can input the required details and submit the necessary documents for a swift update.

Airtel FASTag KYC Update Online:

You May Love To Read

For Airtel FASTag users, the KYC update process can be done online. Open the Airtel app, select “FASTag” under “Recharge & Pay Bills,” and click on “Update KYC.” Follow the prompts to upload the required documents for a quick and convenient update.

FASTag KYC Update Online IDFC:

IDFC FASTag users can update their KYC online through the IDFC mobile banking app or website. Log in to your account, navigate to the FASTag section, and find the “KYC Update” option. Input the necessary details and submit the required documents for a hassle-free update.

IHMCL FASTag KYC Pending:

If your IHMCL FASTag KYC is pending, contact IHMCL customer care for assistance by dialing 1033. They will guide you through the necessary steps to complete the KYC process and resolve any pending issues.

How do I recharge my FASTag if KYC is not done?

Unfortunately, recharging your FASTag is no longer possible without completing KYC due to regulations set by the Reserve Bank of India (RBI). This mandate came into effect on February 29, 2024, aiming to strengthen financial security and prevent misuse of FASTags.

Can I use FASTag without KYC?

Using a FASTag without completing KYC is no longer an option. Your FASTag account might become inactive or restricted upon reaching its minimum balance if KYC is not completed.

How to Check Fastag KYC Online?

Here’s how to check your FASTag KYC status online depending on your issuer:

- Use their respective mobile banking apps or websites

- Login to your account

- Go to “My Profile”

- Access FASTag section

- Look for “KYC Status” or similar information

Conclusion on FASTag KYC Update Online

Keeping your FASTag active is like having a special pass for stress-free drives. When it’s active, toll booths become a breeze, and you unlock all the cool stuff FASTag has to offer – quick payments, higher recharge limits, and extra security. So, during your daily commutes, just give your FASTag a little attention, keep it active, and enjoy every drive without a hitch. Your active FASTag is your ticket to easy and relaxed road trips. Happy travels!. By adhering to the deadline and completing the KYC process with the required documents, users not only avoid penalties but also unlock the full potential of FASTag benefits.

FAQs on FASTag KYC Update Online

What happens if I miss the KYC deadline?

Non-compliance after February 29, 2024, may lead to restrictions or penalties. It’s advisable to complete KYC promptly.

Can I still use FASTag without completing KYC?

Unfortunately, no. Using FASTag without KYC is no longer an option to maintain financial security.

How can I check my KYC status after submission?

Log in to your account on the respective issuer’s platform, go to “My Profile,” and check the FASTag section for “KYC Status.”

Are there specific requirements for document clarity?

Ensure all documents, especially ID and address proofs, are clear, legible, and self-attested for a smooth verification process.

What if my KYC is pending after online submission?

Contact the customer care of the respective issuer (1033 for IHMCL) for assistance and updates.