How to Apply for Lifetime Free IDFC FIRST Bank Credit Cards Online

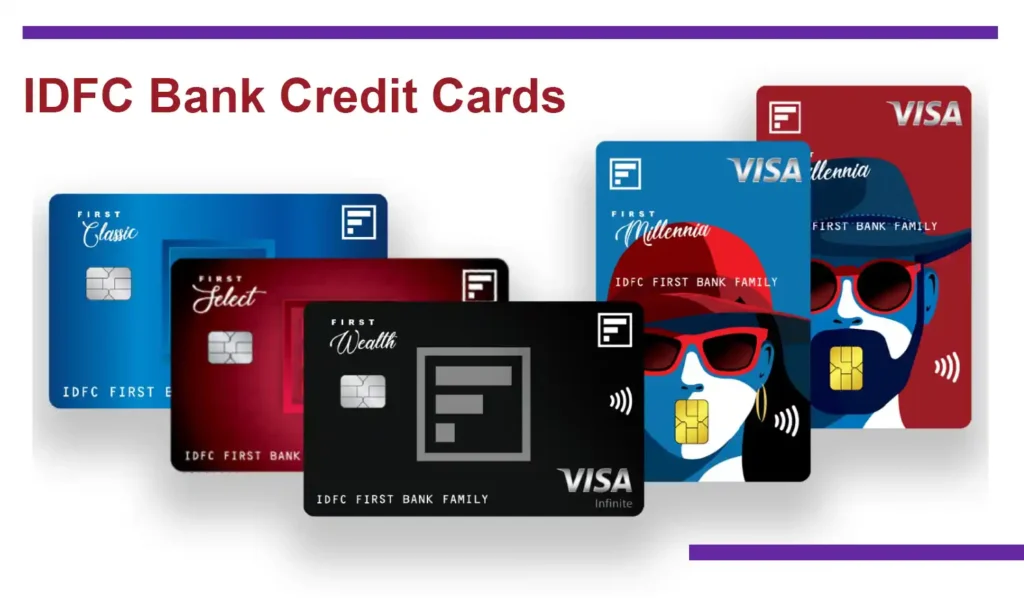

The IDFC FIRST Bank offers a great credit card that is lifetime-free and comes with many benefits. This card is a good choice for people who want to save money while enjoying rewards and other special offers. There are four types of IDFC FIRST Bank Credit Cards: First Classic, First Select, First Wealth, and First Millennia. These cards provide various advantages that make them attractive to many users. In this post, we will explore the benefits, the application process, and important terms and conditions related to the IDFC FIRST Bank lifetime free credit cards.

Benefits of IDFC FIRST Bank Credit Cards

The IDFC FIRST Bank credit cards come with many benefits that make them a popular choice. Let’s look at some of the main benefits:

Lifetime Free

All IDFC FIRST Bank credit cards are lifetime free. This means you do not have to pay any annual fees to keep using the card. This is a big advantage because many other credit cards charge an annual fee.

Reward Points Never Expire

With these credit cards, the reward points you earn never expire. This allows you to collect points over time and use them whenever you want without worrying about losing them.

10X Rewards on High Spending

If you spend more than ₹20,000 in a month, you get 10 times more reward points. This means that high spenders can earn a lot of reward points quickly.

Paper-less, Online Process

Applying for an IDFC FIRST Bank credit card is easy because the whole process is online and paperless. You can apply from the comfort of your home without needing to fill out any physical forms.

Special 10X Rewards on Birthdays

On your birthday, you get 10 times more reward points on your purchases. This special birthday reward makes your day even more special.

Complimentary Railway and Airport Lounge Access

Cardholders get free access to railway and airport lounges. This is a great benefit for people who travel often because it makes their travel experience more comfortable.

Interest-Free ATM Cash Withdrawal

You can withdraw cash from ATMs without paying any interest for up to 48 days. This feature is useful in case of emergencies when you need cash quickly.

Discounts on Movies and Dining

IDFC FIRST Bank credit cards offer discounts on movie tickets and dining at restaurants. This can help you save money while enjoying your favorite activities.

How to Apply for IDFC FIRST Bank Credit Card?

Applying for an IDFC FIRST Bank credit card is simple and can be done online. Here are the steps to apply:

- Visit the IDFC Bank Website

Go to the official IDFC Bank website to start your application process. - Provide Your Details

Enter your name, mobile number, and date of birth. These details are required to start your application. - Fill Out the Complete Form

Provide your income and communication details in the application form. This information is needed to determine which credit card you are eligible for. - Choose Your Credit Card

Based on your details, you will be offered the best credit card for you. Select the card you want and complete your application. - Complete Your KYC Online

Finish your Know Your Customer (KYC) process online. This step is necessary to verify your identity and address. - Application Processing

Your card application will be processed within 5 working days. You will be informed once your application is approved and your card is ready.

Important Terms and Conditions for Apply for IDFC FIRST Bank Credit Card

When applying for an IDFC FIRST Bank credit card, there are some important terms and conditions to keep in mind:

Minimum Income Requirement for Salaried Applicants

Salaried individuals must have a minimum income of ₹30,000 per month to be eligible for the credit card.

Eligible Income for Self-employed Applicants

Self-employed individuals must have an annual income of ₹5,00,000 to be eligible for the credit card.

Age Requirement

For salaried individuals, the age requirement is between 23 and 60 years. For self-employed individuals, the age requirement is between 25 and 60 years.

IDFC Bank Customer Care No

You can reach IDFC FIRST Bank customer care by calling their toll-free number: 1800 10 888. This number is available for any queries, support, or assistance you may need regarding your IDFC FIRST Bank credit card or any other banking services. Also, contact through WhatsApp Banking using the Number 95555 55555.

Conclusion

The IDFC FIRST Bank lifetime free credit cards are a great option for people who want to enjoy many benefits without paying annual fees. With features like never-expiring reward points, high rewards for high spending, a paperless application process, special birthday rewards, complimentary lounge access, interest-free cash withdrawals, and discounts on movies and dining, these cards offer a lot of value.

Applying for these cards is easy and can be done online. Make sure to check the important terms and conditions before applying to ensure you meet the eligibility criteria. Overall, the IDFC FIRST Bank credit cards are a smart choice for those looking to maximize their savings and rewards.