BOB BC Login Process is Changed | Check How To Active BOB KIOSK ID

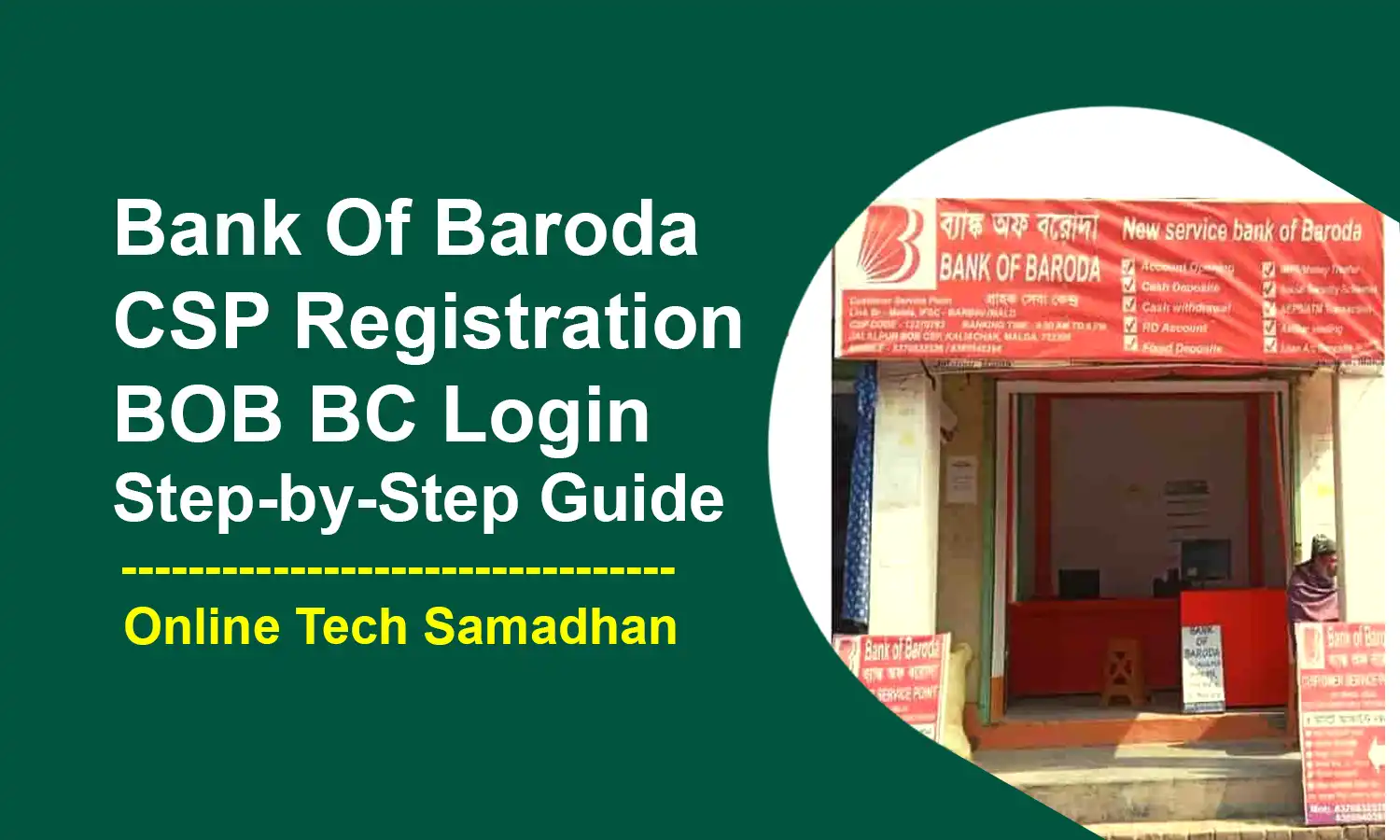

Becoming a Business Correspondent (BC) for the Bank of Baroda (BOB) can be a fulfilling and rewarding experience. By providing banking services to poor and remote communities, you will promote financial inclusion and enhance the neighborhood as a BC. We walk you through the BOB CSP registration and BOB BC login procedures in this complete tutorial so you can begin using your money to improve your town.

How to Get a Bank of Baroda CSP Point

Eligibility Criteria:

To become a Bank of Baroda Customer Service Point (CSP), you should:

- Be an Indian citizen.

- Be at least 18 years old.

- Have passed the 10th standard or equivalent.

- Understand computer applications and the internet.

- Have a suitable shop or office space with the necessary infrastructure.

- Maintain a good credit history.

- Be willing to invest in the required equipment.

If you meet these requirements and have the passion to serve your community, you are well on your way to becoming a BOB BC Login Agent. If you are interested in becoming a BOB BC, I encourage you to contact your nearest BOB branch for more information. You can also easily Get BOB CSP from CSC if you are a CSC VLE.

You May Love To Read

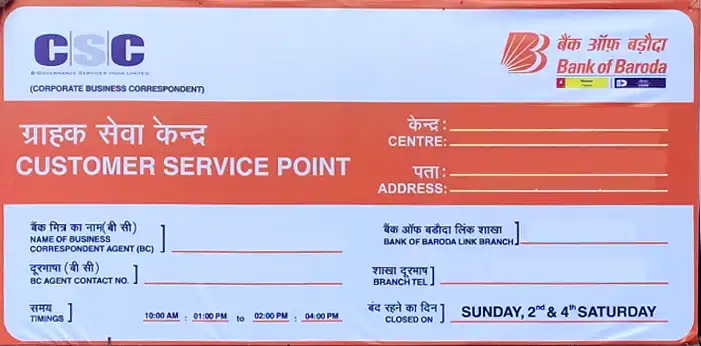

What is CSC BOB CSP? and BOB Kiosk Login

CSC BOB CSP is a service offered through Common Service Centers (CSC) in India. It stands for “Bank of Baroda Customer Service Point.” It enables CSC Village Level Entrepreneurs (VLEs) to become Bank Mitras for BOB, offering essential banking services like account opening, cash transactions, fund transfers, and bill payments using BOB BC Login. Through this initiative, BOB aims to extend financial inclusion and empower people in remote areas with formal banking services.

CSC BOB CSP: Understanding the Process

The Common Service Center (CSC) is a pivotal part of the Digital India initiative, aimed at providing various government and financial services to citizens through the CSC network. BOB CSP is one such service that can be availed through the CSC platform. Here are the documents you need to apply for CSC BOB CSP:

IIBF Certificate: Obtain a certificate from the Indian Institute of Banking and Finance (IIBF) to demonstrate your knowledge and competency in banking services.

Police NOC: Obtain a No Objection Certificate (NOC) from the local police authorities, ensuring that you have a clean record.

PAN Card: Your Permanent Account Number (PAN) card is a mandatory document for identity verification and taxation purposes.

Valid and Active CSC ID: Ensure that you have a valid and active CSC VLE (Village Level Entrepreneur) ID, for getting BOB BC for free.

Current Account: You will need an operational Currant account to facilitate transactions as a BC.

CIBIL Score: A healthy CIBIL score is essential to demonstrate your creditworthiness to the bank.

You May Love To Read

Branch Recommendation Letter: Obtain a recommendation letter from the BOB branch manager, endorsing your suitability as a BC.

CSC Recommendation Letter: Additionally, secure a recommendation letter from the CSC, affirming your association with the center.

Once you have gathered these documents, you are ready to apply for CSC BOB BC registration.

CSC BOB BC Application Process: Step-by-Step

Following these steps will enable you to complete the CSC BOB BC application process smoothly, allowing you to start offering essential banking services to the community through your CSC center. Here is a step-by-step guide to help you through the application:

Register on Bank Mitra Portal: To begin the process, register on the Bank Mitra portal through the Common Services Centre (CSC) website.

Contact District Manager (DM): Get in touch with the District Manager of your CSC State team to request an Overdraft (OD) letter for the application.

Fill Offline Form: Obtain the BOB BC offline form and fill it out accurately with all the required information.

Open OD Account: Open an operational Overdraft (OD) account to facilitate transactions as a BOB BC.

Avail Insurance Schemes: Enroll in the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) and Pradhan Mantri Suraksha Bima Yojana (PMSBY) insurance schemes for added security.

Generate CIBIL Score: Ensure you have a healthy CIBIL score, as it reflects your creditworthiness.

Obtain Required Documents: Gather essential documents such as Police NOC, valid ID proof, PAN card, and the Indian Institute of Banking and Finance (IIBF) certificate.

Submit Documents at BOB Branch: Submit all the required documents to the nearest Bank of Baroda (BOB) branch.

Verification Process: After submitting the documents, the District Manager will send an Excel sheet with your details to the BOB Regional Office for verification. This may take around 15-20 days.

Document Verification and KO Code Generation: The BOB Regional Office will verify your documents and the submission date. Upon successful verification, they will generate your KO (Kiosk Operator) code.

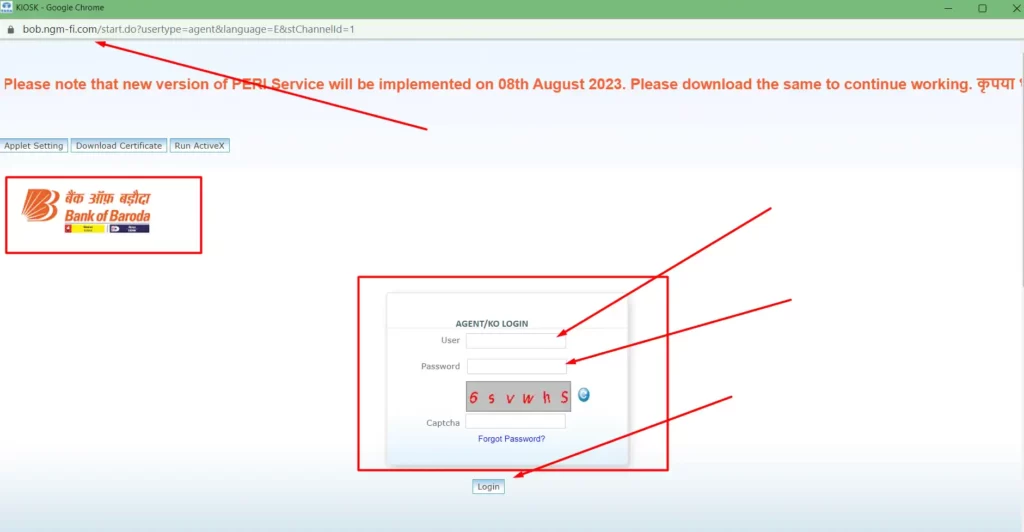

CSC BOB BC Browser Setup

- Go to Web Browser Setting

- Search Pop-ups setting

- Go to Pop-ups and redirect

- Allow Pop-ups for the link

- Now you can able to open the BOB BC Login page

CSC BOB BC Login Process

After your BOB BC registration is approved, you can access banking services using BOB BC Login. Follow these steps:

Step 1: Visit https://bob.ngm-fi.com/ BOB BC Login page

Step 2: Enter your Username and Password

Step 3: Log In to BOB BC Dashboard

Step 4: Access various BOB BC services, including account opening, cash deposits, and withdrawals, fund transfers, bill payments, loan applications, and financial literacy training.

Benefits of Becoming a BOB BC

Before we delve into the registration process, let’s explore the various benefits of becoming a BOB BC:

Income Generation: With BOB BC Login, you will have the opportunity to generate income by providing essential banking services to customers in your area. The commissions and fees earned from these services can serve as an additional source of income for you.

Promoting Financial Inclusion: By acting as a bridge between the bank and the unbanked or underbanked individuals, you will enable them to access formal banking services, fostering financial inclusion and empowerment.

Knowledge Enhancement: Becoming a BC will offer you a chance to gain a comprehensive understanding of various banking products and services. This knowledge can be valuable for personal growth and future endeavors.

Financial Literacy Training: As a BOB BC, you will have the opportunity to provide basic financial literacy training to the people in your community. Educating them about financial management can lead to better financial decisions and economic progress.

Conclusion

Becoming a BOB BC through CSC registration opens the door to new opportunities for both you and the community you serve. You may greatly improve the economic development and well-being of your community by offering crucial banking services by doing BOB BC Login.

Always keep in mind that the goal of this trip is to equip people with the information and tools they need to create a secure financial future, not only to generate revenue. So, start moving in the right direction right now and help your neighborhood transform for the better.

To begin the BOB CSP registration procedure and set off on a road of social impact and personal growth, get in touch with your local BOB branch or go to the official CSC website. Let’s create an India that is economically open together.

FAQs

What is BOB CSP Registration?

BOB CSP registration is the process of becoming a Bank of Baroda Business Correspondent (BC). BCs provide essential banking services to underserved areas, fostering financial inclusion.

How can I become a BOB BC?

To become a BOB BC, you need to be a resident of India with a valid PAN card and Aadhaar card. Additionally, you should have a sound understanding of banking products and services.

What services can I offer as a BOB BC?

As a BOB BC, you can provide services such as account opening, cash deposits and withdrawals, fund transfers, bill payments, and loan applications.

How do I access BOB BC Login?

After becoming a BOB BC, you can access the BOB BC login to offer banking services. The login provides easy access to a range of transactions for your customers.

What are the benefits of becoming a BOB BC?

Becoming a BOB BC offers various benefits, including income generation, empowering your community with banking services, and enhancing your banking knowledge.