Done with IDFC FIRST Bank: Explore How to Close IDFC First Bank Account

IDFC First Bank provides a range of financial services to customers, including savings accounts, current accounts, and fixed deposits. However, sometimes customers may need to close their bank accounts for various reasons, such as relocation, transferring to another bank, or dissatisfaction with the services offered by the bank. If you have an IDFC First Bank account that you would like to close, this post will guide you How to Close IDFC First Bank Account step-by-step.

IDFC FIRST Bank Overview

| Category | Information |

|---|---|

| Type | Private Sector Bank |

| Formed by Merger | Merger of IDFC Ltd. and Erstwhile Capital Ltd. in 2018 |

| Headquarters | Mumbai, Maharashtra, India |

| Website | https://www.idfcfirstbank.com/ |

| Key Products | Savings Accounts, Current Accounts, Fixed Deposits, Demat Accounts, Loans (Home Loan, Car Loan, Personal Loan etc.), Credit Cards, Wealth Management Services |

| Focus | Retail Banking and Corporate Banking |

Apply The IDFC FIRST Bank Credit Card Online

Before You Begin: Getting Prepared

Here are a few things to keep in mind before you close your IDFC FIRST Bank account:

Inform the Bank of Your Decision

You May Love To Read

Firstly, you need to visit your nearest IDFC First Bank branch and inform them of your decision to close your account. You will be provided with an account closure form that you need to fill out. Make sure to provide all necessary details such as your account number, reason for closing the account, and personal information.

Clear All Debts and Outstanding Charges

Before you can close your account, you need to ensure that there are no outstanding debts or charges on the account. This includes unpaid balances, overdraft amounts, and any other fees charged by the bank. If there are any unsettled amounts, clear them before you proceed with the closing of the account.

Transfer your money:

If you have any funds remaining in your account, you’ll need to transfer them somewhere else. You can transfer it to another bank account you own or withdraw it in cash.

Update linked services:

Think about any services linked to your account, like automatic bill payments (ECS) or debit card subscriptions. Update these to use a different payment method before closing the account.

Return All Unused Cheque Books, Passbooks, and Debit Cards

You May Love To Read

You must return all unused and invalid cheque books, passbooks, and debit cards associated with the account before you close it. This ensures that your personal information and finances are kept secure. Make sure to obtain a receipt for the returned items.

Choosing IDFC First Bank Account Closure Method:

There are two main ways to close your IDFC FIRST Bank account:

Method 1: How to Close IDFC First Bank Account at Your Home Branch

- Gather your documents: Ensure you have valid ID proof such as your Aadhaar card or PAN card, along with your bank account details including the account number and type.

- Visit your home branch: Head to the IDFC FIRST Bank branch where you initially opened your account.

- Meet a customer service representative: Inform the representative that you wish to close your account.

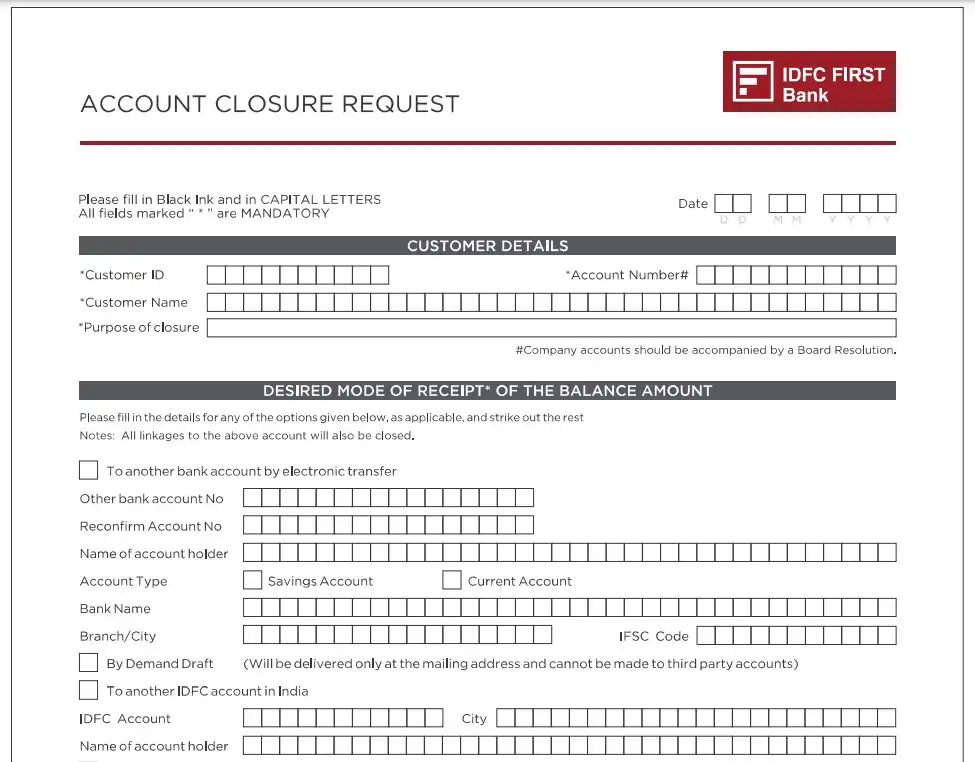

- Fill out the account closure form: The bank representative will provide you with a form to complete. This form typically requests your account details, reason for closure, and confirmation of any outstanding dues.

- Submit the form and your documents: Once the form is filled out and verified, hand it in along with your ID proof to the bank representative.

- Collect confirmation: Await processing of your request by the bank. You will receive confirmation of your account closure, which could be in the form of a closure letter or a message through Internet banking.

IDFC First Bank Account Closure Application Form PDF

Redirect Link Content

Method 2: How to Close IDFC First Bank Account Online

- Log in to your IDFC FIRST Bank internet banking account.

- Navigate to the account management or closure section.

- Follow the on-screen instructions to initiate the closure process.

- Provide the necessary details and complete the online form.

- Upload scanned copies of your ID proof, if required.

- Specify where any remaining balance should be transferred.

- Submit the information and wait for the bank to process your request.

- Receive confirmation of closure via email or internet banking message.

Note: Online account closure may not be available for all account types. Contact IDFC FIRST Bank for specific details on closing your account online.

IDFC FIRST Bank Customer Care Number

| Contact Method | Details | Availability |

|---|---|---|

| Toll-Free Number | 1800 10 888 | 24/7 |

| WhatsApp Banking | 9555 555 555 | Send a “Hi ” message to initiate chat |

Conclusion on How to Close IDFC First Bank Account

Closing an IDFC First Bank account can be a simple and easy process if you follow the steps outlined above. It is important to ensure that all outstanding debts and charges are cleared, and all unused cheque books, passbooks, and debit cards are returned to the bank. Remember, you need to inform the bank of your decision to close the account and submit a closure form. By following these steps, you can safely and securely close your IDFC First Bank account.