IDFC FIRSTmoney: All-in-One Guide Eligibility to Application Process

IDFC Bank FIRSTmoney, the instant personal loan solution from IDFC Fast Bank. In today’s fast-paced world, financial needs can arise suddenly, leaving individuals in search of a quick and convenient source of funds. With FIRSTmoney, IDFC Fast Bank has revolutionized the personal lending landscape, offering a seamless and efficient process that guarantees instant loan approvals. Say goodbye to lengthy application procedures, piles of paperwork, and agonizing waiting periods. IDFC FIRSTmoney is designed to address urgent financial obligations, unexpected expenses, or personal aspirations promptly and hassle-free.

What is FIRSTmoney?

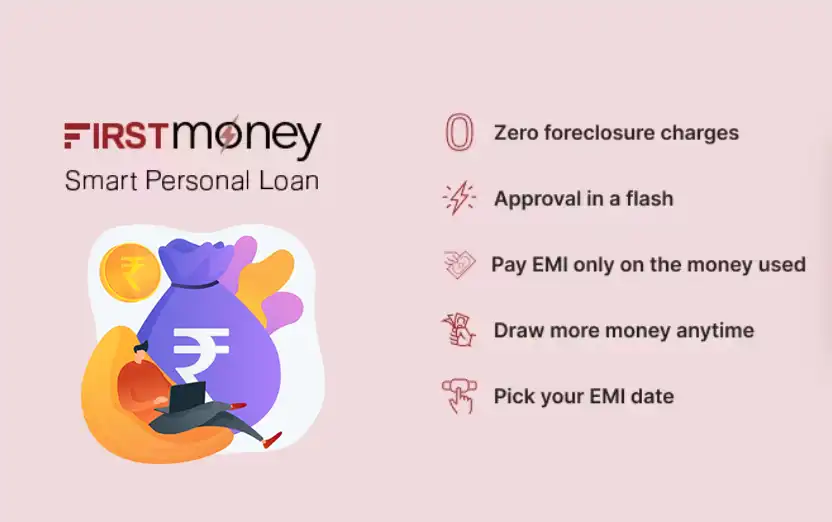

FIRSTmoney is the instant personal loan solution offered by IDFC Fast Bank. It is designed to provide individuals with a quick and convenient source of funds to address their financial needs. With FIRSTmoney, you can apply for a loan and get instant approval, eliminating the need for lengthy application procedures and paperwork. It offers competitive interest rates and flexible repayment options, allowing borrowers to repay the loan on their terms.

Features of FIRSTmoney

Let’s explore the features of FIRST money that make it the ultimate financial solution:

You May Love To Read

- Maximum credit limit: Need a substantial amount? FIRST money offers credit lines of up to ₹10 lakh.

- Minimum loan amount: Whether it’s a small expense or a big-ticket purchase, you can borrow as little as ₹5,000.

- Competitive interest rates: Starting from just 10.99% per annum, FIRSTmoney ensures that you get the best deal possible.

- Flexible tenure: Choose a repayment period that suits you, ranging from 2 to 60 months.

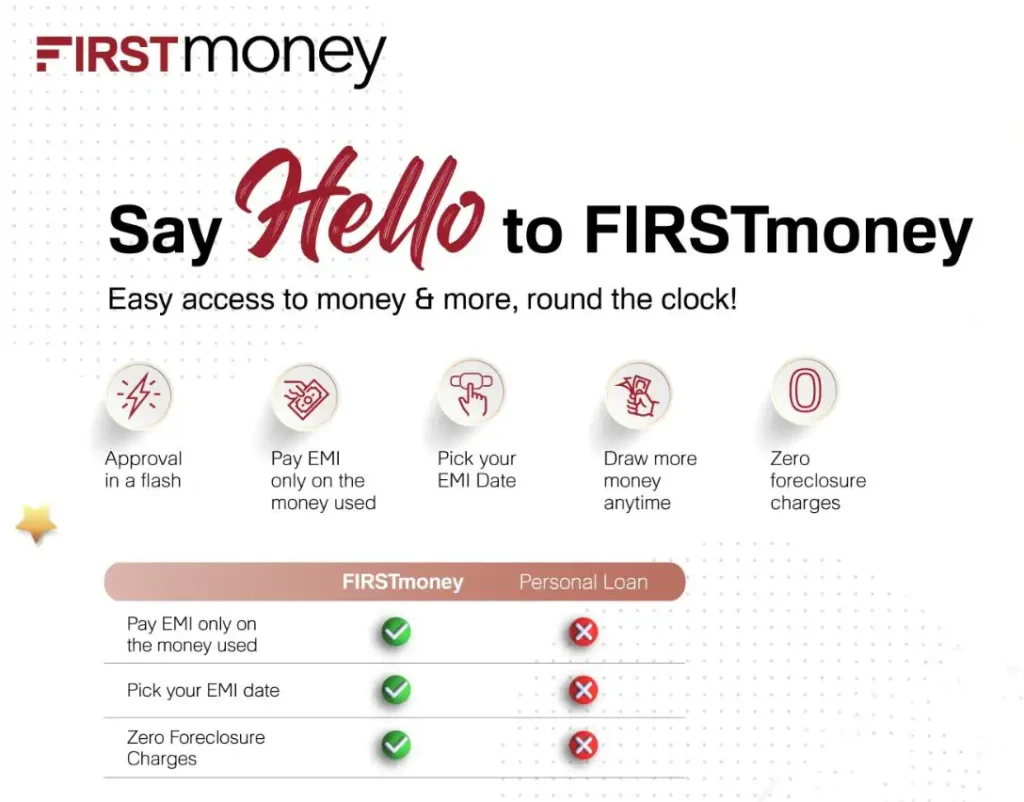

- Zero foreclosure charges: Unlike traditional loans, FIRST money lets you repay your outstanding amount whenever you want, without any extra fees.

Key Benefits of IDFC FIRSTmoney

Here are the key benefits of IDFC FIRST Bank FIRSTmoney:

- Foreclosure Benefits: FIRSTmoney allows you to repay your loan amount at any time without hefty foreclosure charges. This gives you the freedom to manage your finances and pay off your loan whenever you want.

- Loan Amount Flexibility: Whether you need a small amount or a larger sum, FIRSTmoney gives you the flexibility to borrow any amount within your credit limit, ranging from ₹5,000 to ₹10 lakh. You are in control of choosing the loan amount that suits your specific needs.

- Multiple Withdrawals: FIRSTmoney allows you to make multiple withdrawals from your credit line as per your requirements. You can withdraw funds starting from as little as ₹5,000, providing you with the convenience of accessing funds whenever you need them.

- Flexible Loan Repayment Options: Say goodbye to rigid repayment plans. FIRSTmoney offers customizable EMI options, allowing you to choose a repayment schedule that works best for you. This flexibility ensures that you can manage your loan repayments comfortably, without straining your finances.

- Swift Disbursal: FIRSTmoney’s advanced technology enables you to complete the entire application process online. Once approved, the funds are disbursed instantly into your bank account. This eliminates the need for long waiting periods, making the process quick and hassle-free.

Apply The IDFC FIRST Bank Credit Card Online

Eligibility Criteria for FIRSTmoney

There are the eligibility criteria for IDFC FIRST Bank FIRSTmoney:

- You must be a salaried individual.

- Your age must fall between 21 and 60 years.

- You must possess a valid physical PAN Card.

- Your CIBIL score should be 750 or above.

- Valid government-issued ID proof that includes address, date of birth, and photograph for video e-KYC.

If you meet all of the above criteria, you are eligible to open a FIRST money account and start enjoying the benefits of digital banking.

How to Apply for FIRSTmoney Personal Loan?

Ready to take the first step towards financial freedom? Here’s how to apply for FIRSTmoney:

- Scan the QR code: Begin your digital journey by scanning the QR code provided.

- Register with your mobile number: Enter your mobile number to create your account.

- Confirm your details: Verify your basic information to check your eligibility.

- Select your loan: Choose your preferred loan details, including the amount and tenure.

- Link your bank account: Connect your bank account for seamless transactions.

- Complete KYC: Verify your identity through the video KYC process.

- Enjoy swift disbursal: Once approved, your funds will be disbursed directly into your bank account.

Fees & Charges of FIRST money Personal Loan

At IDFC FIRST Bank, transparency is key. Here’s the charges list:

- Processing fees: 2% (including GST)

- Late payment charges: 2% of the unpaid EMI

- Stamping charges: As per actuals

- EMI bounce charges: ₹500 per presentation

- Cheque/mandate swap charges: ₹500 per swap

- EMI pickup/collection charges: ₹500

- Duplicate NOC issuance charges: ₹500

- Physical statement charges: ₹500

- Foreclosure/prepayment charges: NIL

- Document retrieval charges: ₹500 per retrieval

Cooling-Off Period

FIRST money offers its customers a cooling-off period of three days after getting the loan disbursed. If for any reason, you feel like the loan product does not meet your expectations, you can opt to exit the loan within the cooling-off period. To exit the loan, you will need to pay the principal amount you’ve borrowed along with the proportionate charges accrued during the cooling-off period.

You can exit the loan without answering any questions. This feature is designed to provide customers with peace of mind and the assurance that they can always change their minds within the first three days of taking out the loan.

You May Love To Read

Conclusion

IDFC FIRST Bank’s FIRST money is an excellent loan product that offers a range of benefits to its customers, including instant approvals, competitive rates, no foreclosure charges, a cooling-off period, and flexible repayment options. It provides you with the financial freedom and control to achieve your life goals without the burden of extensive loans. So, if you’re looking for a reliable and hassle-free loan product, FIRSTmoney is the right choice for you. Apply for FIRSTmoney today and take a step towards achieving your dreams.