Understanding the Post Office Monthly Income Scheme for Senior Citizens

Post Office Monthly Income Scheme (POMIS) is an investment option offered by India Post, specifically designed to provide a steady and predictable source of monthly income. This scheme is open to all individuals, including senior citizens, who are looking for a secure investment avenue. In this article, we discuss How the Post Office Monthly Income Scheme for Senior Citizens is Beneficial, its features, benefits, and considerations for senior citizens.

POMIS Scheme Overview

The Post Office Monthly Income Scheme (POMIS) is a fixed-income investment scheme provided by India Post. It is a popular choice for individuals seeking a safe and regular income stream. POMIS is known for its reliability and simplicity, making it appealing to senior citizens who prioritize stability in their investment portfolios.

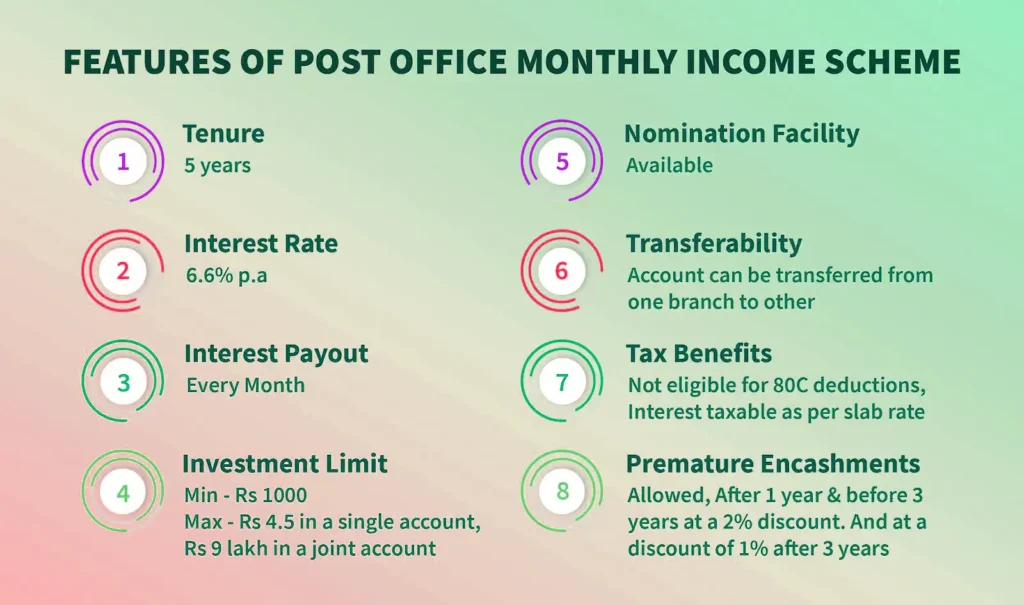

POMIS Scheme Features and Benefits

The POMIS offers several features and benefits that make it an attractive investment option:

You May Love To Read

- How to Close IDFC First Bank Account: A Beginner’s Guide 2024

- CSC District Manager List: Updated Name and Contacts 2024

- Indane Gas Booking New Number: Quick and Smart Solutions

- eSIM Technology in 2024: 5 Secrets of Digital Connectivity

- How to Boost Sales with Instagram DM Marketing: 2024 Proven Strategy

Monthly Income: POMIS provides a fixed monthly income to investors. This ensures a regular inflow of funds that can be utilized to meet day-to-day expenses or cover financial commitments.

Fixed Interest Rate: The scheme offers a fixed interest rate, which provides clarity and predictability in terms of returns. As of April 2024, the current interest rate for POMIS is 7.4% per annum (subject to change).

Low Risk: POMIS is considered a low-risk investment option as it is backed by the government of India. This provides a sense of security to investors, especially senior citizens who may prefer stability over higher-risk investments.

Easy Accessibility: With the presence of a vast network of post offices across the country, POMIS is easily accessible to individuals in both urban and rural areas. This convenience makes it a popular choice among senior citizens.

POMIS Scheme Eligibility and Investment Limits

POMIS is open to all individuals, including senior citizens. To open a POMIS account, an individual must be at least 18 years old. There is no maximum age limit for opening an account.

In terms of investment limits, the maximum investment allowed in a single POMIS account is Single Account ₹4,50,000, Joint Account ₹9,00,000, a Minor Account: is ₹3,00,000 and the minimum amount to deposit is ₹ 1500. For joint accounts, the maximum investment limit is ₹15 lakh. A minimum of 5 years is the lock-in period which can be withdrawn after maturity. This means that senior citizens can invest up to these limits and earn a fixed monthly income based on their investment amount.

POMIS Scheme Interest Rates and Payouts

The interest rate offered by POMIS is subject to change and is revised by the government from time to time. As of April 2024, the interest rate for POMIS stands at 7.4% per annum. It is important to note that this rate may vary in the future based on economic conditions and government policies.

The interest earned on POMIS investments is credited to the investor’s account every month. This ensures a regular income stream for senior citizens, which can be useful for meeting their financial needs.

You May Love To Read

- Galaxy S24 Ultra vs iPhone 15 Pro Max: Which Should You Buy?

- How To Check Your Mobile Is Hacked or Safe? Using This Mobile App 2024

- Best Term Insurance Plans in USA: Secure Your Loved Ones

- Jio 5G Recharge Plan – सिर्फ 61 रुपये में Jio का धमाकेदार ऑफर

- Axis Bank Credit Card Customer Care: 24×7 Toll-Free Support

Current Interest Rates:

Duration (in Years): 1, Interest Rate: 5.50%

Duration (in Years): 2, Interest Rate: 5.50%

Duration (in Years): 3, Interest Rate: 5.50%

Duration (in Years): 5, Interest Rate: 7.6%

Required Documents for Open a POMIS Account

To open a POMIS account, you would typically require the following documents:

- Proof of Identity: – Copy of government-issued ID such as Passport – Voter ID card – Driving License – Aadhaar card

- Proof of Address: – Government-issued ID (which also serves as proof of address) – Recent utility bills (electricity, water, gas, etc.)

- Passport-size photographs: – You need a few passport-sized photographs for the account opening process.

How to Open a POMIS Account?

Opening a POMIS account is a simple process. Senior citizens can follow the steps below to open a POMIS account:

- Visit the nearest post office that offers the POMIS facility.

- Collect the POMIS Application Form from the post office counter.

- Fill in the necessary details in the application form, including personal information, investment amount, and nominee details.

- Submit the filled-in application form along with the required documents, such as identity proof, address proof, and passport-sized photographs.

- Deposit the investment amount as per the specified guidelines.

- Once the application is processed and approved, the POMIS account will be opened, and the investor will receive the necessary documents and account details.

Download the POMIS Application Form PDF

Redirect Link Content

Post Office Monthly Income Scheme Calculator

Using the Post Office MIS Calculator is quite simple. You input the desired investment amount and select the tenure (investment period) for your POMIS. The calculator then utilizes the current interest rate offered by POMIS to calculate your estimated monthly interest income and the total maturity amount.

POMIS Scheme Tax Implications

When it comes to tax implications, the interest earned from POMIS investments is taxable as per the individual’s income tax slab. Senior citizens need to consider this factor and consult with a tax advisor to understand the impact on their overall tax liability.

POMIS Comparison with SCSS (Senior Citizen Savings Scheme)

While POMIS is a suitable investment option for senior citizens, it is essential to consider other options available in the market. One such option is the Senior Citizen Savings Scheme (SCSS), which is exclusively designed for individuals aged 60 and above.

The SCSS offers a higher interest rate compared to POMIS, making it an attractive choice for senior citizens looking for enhanced returns. As of April 2024, the interest rate for SCSS stands at 8.2% per annum (subject to change). However, it is important to note that SCSS payouts are made quarterly, unlike the monthly payouts offered by POMIS.

Considerations for Post Office Monthly Income Scheme for Senior Citizens

When deciding between POMIS and SCSS, senior citizens need to consider their individual financial goals and preferences. Here are a few key considerations for senior citizens:

Regular Income: If senior citizens prioritize a steady monthly income, POMIS may be the preferred option due to its monthly interest payouts.

Higher Returns: On the other hand, if maximizing returns is the primary goal, and quarterly payouts are acceptable, senior citizens may opt for SCSS, which offers a higher interest rate.

Investment Limit: Senior citizens should also consider the investment limits associated with POMIS and SCSS. POMIS has a lower investment limit, while SCSS allows investments up to ₹30 lakh (including existing SCSS accounts).

Conclusion on Post Office Monthly Income Scheme for Senior Citizens

Post Office Monthly Income Scheme for Senior Citizens serves as an excellent investment option for senior citizens seeking a stable and regular source of income. With its fixed interest rate and monthly payouts, POMIS offers financial security and ease of accessibility through the vast post office network.

However, senior citizens need to weigh their options and consider factors such as interest rates, payout frequency, and investment limits. Comparing Post Office Monthly Income Scheme for Senior Citizens with other schemes like the Senior Citizen Savings Scheme (SCSS) can help senior citizens make informed decisions based on their unique financial goals and preferences.

By understanding the features, benefits, and considerations associated with POMIS, senior citizens can confidently make investment choices that align with their financial needs.