Get Quick2Lend Loans for Your Urgent Financial Needs

In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s for a medical emergency, home repair, or simply managing your day-to-day expenses, having access to quick and reliable loans can be a lifesaver. Quick2Lend, an online loan broker, aims to provide a seamless platform connecting borrowers with lenders to meet their financial needs efficiently. In this review, we’ll delve into the ins and outs of Quick2Lend loans, examining their features, pros and cons, and exploring viable alternatives.

Quick2Lend in a Nutshell

Quick2Lend stands as an online platform that bridges the gap between borrowers in need of quick financial assistance and a network of lenders. With a focus on simplicity and speed, they offer a range of loan types, including short-term loans, installment loans, and personal loans, to cater to various financial situations.

Quick2Lend Loans: Which types of loan they provide?

Quick2Lend provides three types of loans:

You May Love To Read

- Personal loans: These loans are unsecured, which means they are not backed by collateral. Personal loans can be used for any purpose, such as debt consolidation, home improvements, or medical expenses.

- Installment loans: These loans are also unsecured, but they have a fixed repayment schedule. Installment loans are typically used for larger purchases, such as a car or a boat.

- Short-term loans: These loans are typically for small amounts of money and have a very short repayment term, such as 14 days or 30 days. Short-term loans are often used for emergency expenses, such as car repairs or medical bills.

Quick2Lend Loan Eligibility Criteria: Who Can Apply?

To be eligible for a Quick2Lend loan, you need to meet the following requirements:

- Citizenship or Permanent Residency: You must be a citizen of the United States or hold a valid permanent residency status.

- Valid Checking Account: You are required to have an active and valid checking account. This account will be used for the disbursement of the loan funds and repayments.

- Age Requirement: Applicants should be at least 18 years old. This ensures that you are legally considered an adult and can enter into financial agreements.

- Financial Information: During the application process, you will need to provide basic financial details. This includes information about your income and expenses. This helps the lender assess your financial situation and determine your repayment capacity.

- Quick2Lend Minimum Credit Score: While not always mandatory, Quick2Lend may consider your credit score as part of the application process. At least 580 might be required to qualify for a loan. Keep in mind that requirements can vary.

What are the Benefits of Quick2Lend Loans?

- Funds Deposited Directly: The approved loan amount, ranging from $250 to $3000, is directly deposited into your bank account. This ensures fast access to the funds you need.

- Inclusive Credit Assessment: Quick2Lend considers all credit histories, including those with less-than-perfect credit. This opens up borrowing opportunities for a broader range of individuals.

- Effortless Online Process: The loan application process is designed to be quick, secure, and hassle-free. You can complete the entire process online, eliminating the need for extensive paperwork or visits to a physical location.

- Simple Loan Quote: Quick2Lend provides a straightforward loan quote, giving you a clear understanding of the loan terms, including the amount you’re eligible for and the associated repayment terms.

- Swift Approval: Thanks to the streamlined online form, the approval process is expedited. You can expect a quicker response, reducing the waiting time for your loan decision.

Application Process Made Effortless

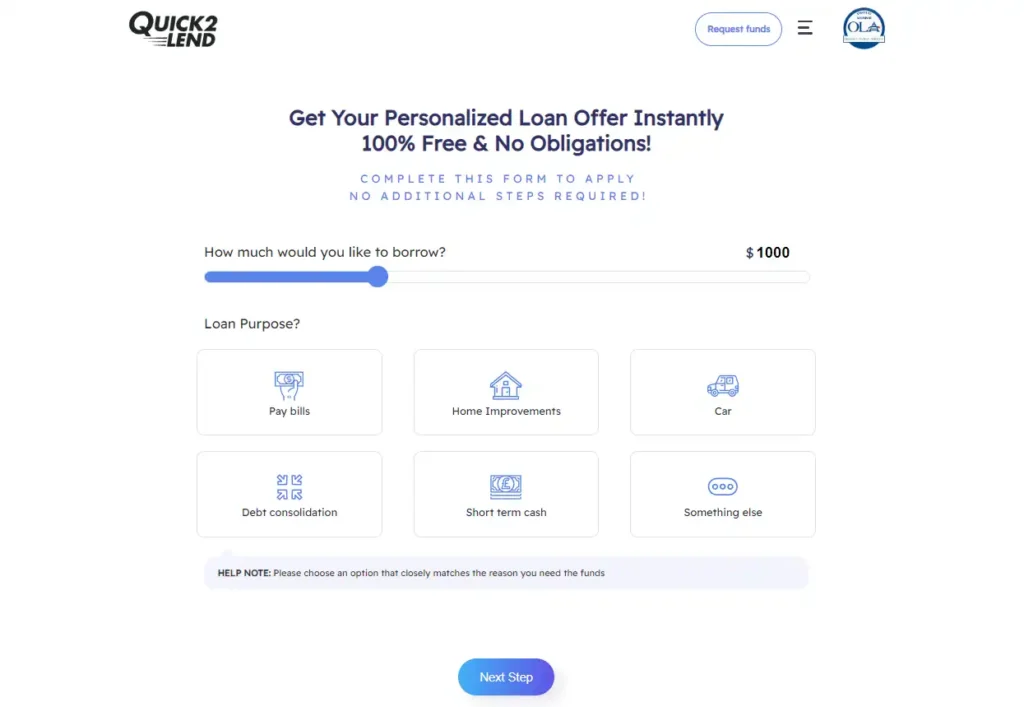

The Quick2Lend loan application process is designed to be user-friendly and convenient. Following these steps allows you to complete your application online

- Visit the Quick2Lend Website: Begin by navigating to the official Quick2Lend website using your preferred web browser.

- Click “Apply Now”: Look for the prominent “Apply Now” button on the website’s homepage and click on it. This will initiate the loan application process.

- Enter Your Basic Information: You’ll be prompted to provide essential personal details. This includes your full name, residential address, and Social Security number. Make sure the information you provide is accurate.

- Provide Financial Details: Quick2Lend needs to understand your financial situation. Input information about your income sources, such as your job or other sources of earnings. Additionally, share details about your monthly expenses, giving the lender a comprehensive view of your financial stability.

- Select Loan Amount and Term: Depending on your needs, choose the loan amount you require and the desired repayment term. This step helps customize the loan to your specific financial situation.

- Review and Submit: Take a moment to review all the information you’ve entered. Ensure that it’s accurate and complete. Once you’re confident, hit the “Submit” button to send your application.

Funding at Lightning Speed: Approval and Disbursement

After submitting your application, Quick2Lend’s team conducts a review and works to match you with a suitable lender. Once approved, the funds are typically deposited into your checking account within 5-10 mins. This swift turnaround ensures that you have access to the funds you need when you need them the most.

The Diversity of Loan Options

Quick2Lend understands that financial needs vary, and thus, they offer an array of loan options. Borrowers can typically secure loans ranging from $250 to $3,000, offering flexibility to address a range of expenses. However, it’s crucial to remember that the specifics of loan terms will depend on the lender you’re matched with.

Navigating the Terms: Interest Rates and Fees

The terms of Quick2Lend loans can vary significantly based on the lender and your credit score. While they strive to offer competitive interest rates and repayment terms, it’s essential to carefully review the terms presented to you before proceeding. Interest rates, repayment periods, and potential fees should be weighed against your financial capabilities.

The High-Cost Loan Conundrum

It’s imperative to acknowledge that Quick2Lend loans are considered high-cost loans. This classification indicates that these loans often come with higher interest rates and fees compared to loans offered by traditional banks. Thus, it’s advisable to explore all available options and evaluate the overall cost before committing to a Quick2Lend loan.

The Bright Side: Pros of Quick2Lend Loans

Quick2Lend’s service does come with several advantages, including:

- Wide Lender Network: With a vast network of lenders, Quick2Lend increases the likelihood of finding a loan suitable for your needs.

- Effortless Application: The application process is quick and straightforward, often resulting in pre-approval within minutes.

- Competitive Rates: Quick2Lend strives to offer competitive interest rates and repayment terms, enhancing borrower affordability.

- Reputation for Service: The platform enjoys a positive reputation for its customer service, adding an element of trust and reliability.

- Quick Approval: As the name suggests, Quick2Lend’s approval process is prompt, ensuring swift access to funds.

- Fast Disbursement: Once approved, funds are usually transferred within 1-3 business days.

- No Up-Front Costs: Quick2Lend generally does not require up-front fees or costs, minimizing initial financial strain.

- Accessibility for Poor Credit: Quick2Lend extends its services to borrowers with bad credit, providing opportunities where traditional lenders might not.

The Flip Side: Cons of Opting for Quick2Lend Loans

However, it’s equally important to consider the potential downsides:

You May Love To Read

- Credit Dependency: Borrowers with bad credit might face higher interest rates and fees.

- Fee Burden: While convenient, Quick2Lend loans can carry substantial fees.

- Limited Loan Comparison: Unlike some platforms, Quick2Lend might not allow side-by-side comparison of loan offers.

- Costly Affair: High-interest rates and fees can significantly inflate the total repayment amount.

- Short Repayment Windows: Some borrowers might find the repayment terms challenging to manage.

Exploring Alternatives: Other Lenders to Consider

If Quick2Lend doesn’t align with your preferences, several alternative lenders could be viable options:

- LendingClub

- Prosper

- Upstart

- SoFi

- Earnest

These lenders offer a variety of loans, from personal loans to student loans, often with more competitive interest rates and fees compared to Quick2Lend.

Factors to Scrutinize While Reviewing a Loan

When evaluating a Quick2Lend loan offer, several crucial factors deserve your attention:

- Interest Rate: The rate significantly impacts the total repayment cost and varies based on your creditworthiness.

- Repayment Term: The period given to repay the loan will influence the overall amount you pay in interest.

- Fees: Quick2Lend levies fees for application processing and loan setup. Ensure you understand these costs.

- Customer Service: While Quick2Lend has a good reputation, reading other borrowers’ reviews is wise.

- Comparison Shopping: Always explore multiple offers and platforms to make an informed decision.

Making an Informed Decision with Quick2Lend Review

Quick2Lend presents a reliable and efficient platform for accessing necessary funds swiftly. However, due to the higher costs associated with their loans, it’s crucial to assess your financial situation comprehensively before committing. By comparing alternatives and thoroughly understanding the terms, you can navigate the world of online lending more confidently.

Conclusion: Your Path to Financial Empowerment

Quick2Lend stands as a dependable platform for borrowers seeking fast financial solutions. With a straightforward application process and swift funding, it offers convenience. However, the higher costs associated with their loans demand careful consideration. By exploring alternatives and understanding the nuances of loan terms, you can confidently navigate the lending landscape and make informed financial choices.

FAQs

Are Quick2Lend loans available to non-U.S. citizens?

Quick2Lend loans are exclusively available to U.S. citizens and permanent residents.

What’s the typical loan approval timeframe?

Once you submit your application, Quick2Lend usually provides loan approval within minutes if all the details is ok.

Can Quick2Lend loans help improve my credit score?

While prompt repayments might positively impact your credit, consider the costs carefully before borrowing.

What happens if I miss a repayment?

Missing repayments could result in late fees and negatively affect your credit score. Contact Quick2Lend if you anticipate difficulties.

Can I repay my Quick2Lend loan early?

Most lenders allow early repayment, often without prepayment penalties. Consult your lender for specifics.