MiFLOW Login (MERC) – Empowering Businesses with Micro Finance Collection Repository by L&T Finance

Starting a business requires both experience and financial support. If you’re considering taking a loan to kickstart your entrepreneurial journey, then you’ll be interested in learning about a renowned company that provides loans for short and long-term in the finance market.

L&T Finance, a well-established financial institution, has launched an impressive web portal called MIFLOW, which simplifies the process of obtaining a loan. In this article, we’ll delve into what MIFLOW is, how to use it, the MiFLOW login process, and all the essential information related to this microfinance collection repository.

What is the MIFLOW Web Portal?

The full name of Mi-FLOW is the Microfinance Collection Repository Portal, also referred to as the MERC Portal. Mi-Flow is a microfinance web portal introduced by L&T Finance. Over the past few years, it has provided loan services and monetary assistance to over 500,000 individuals in India, enabling them to establish their businesses.

You May Love To Read

- sAMOLED Display or AMOLED: Making the Right Choice for Your Smartphone

- How to fix PageSpeed Insights Error Solved Detailed Guide 2024

- Do you Know How Facebook Business Suite Manage Facebook?

- How To Growing Your Adsense Revenue with Adsense Ad Manager?

- What is Microsoft Phi-2, Microsoft’s New Small Language Model

Due to its diverse range of services, Mi-Flow remains a popular choice among customers even today. The full name of MiFlow is the Microfinance Collection Repository Portal, and it is commonly referred to as the MERC Portal.

| Post Name | MIFLOW Login |

|---|---|

| Objective | Mi-FLOW (MERC) – Web portal for easy access to microloans, empowering entrepreneurs. |

| Benefits | Empowering women entrepreneurs with easy access to microfinance, a simplified login process, flexible loan repayment options, no collateral required, and support for small-scale businesses to foster economic growth. |

| Loan Amount | Up to Rs. 45,000 – substantial financial support for small-scale businesses. |

| Loan Tenure | Maximum 24 months – flexible repayment options. |

| Documents | Bank statements, Aadhaar card, PAN card, and other identification documents. |

| Eligibility | Women Applicants aged 20 to 60 years are eligible for microloans. |

| Official Website | https://miflow.ltferp.com/mficollections/ |

Services Offered by MiFlow – Comprehensive Financial Solutions

MIFLOW, launched by L&T Finance, provides an array of services to its customers, which include:

- Mi-flow Access Management

- LTFERP Access Management System

- Miflow SSC Login

- L&T Collection App

- SSC Login L&T

- LTFS Microfinance

- Miflow LTFERP Login

Empowering Women Entrepreneurs with L&T Microfinance

L&T Finance is dedicated to supporting women entrepreneurs by offering microloans tailored to sustain their businesses. These microloans provide a financial boost of up to Rs. 45,000 and a convenient tenure of 24 months, ensuring stability and long-term financial sustainability for this empowering initiative.

Key Features of L&T Microfinance

Nominal Processing Fees: L&T Finance charges a mere 1% as processing fees for these microloans, making it a cost-effective solution for aspiring women entrepreneurs.

No Collateral Needed: Women entrepreneurs can access these microloans without the burden of providing collateral, easing the loan application process.

Flexible Repayment: Borrowers have the flexibility to create a monthly repayment plan that suits their financial capabilities, offering convenience and ease of repayment.

Age Eligibility: The minimum age requirement to apply for this microloan is 20 years, while the maximum age is capped at 60 years, allowing a broad spectrum of women to benefit from this opportunity.

Exclusively for Women: L&T Finance offers these microloans exclusively to women, recognizing the vital role they play in driving economic growth and empowerment.

You May Love To Read

Maximum Loan Amount: The microloan amount extends up to Rs. 45,000, providing a substantial financial boost to fuel business growth.

Convenient Tenure: The microloan tenure is set at a maximum of 24 months, ensuring manageable repayment terms for the borrowers.

Important Information about MiFlow – Empowering Women Entrepreneurs

Here are some crucial details related to MIFLOW:

- L&T Microfinance exclusively offers loans to women; men are not eligible for loans from this portal.

- To join this portal, the applicant’s age must be between 20 and 60 years.

- Loans are provided for periods exceeding 2 years.

- The maximum loan amount available through this portal is Rs. 45,000, with a 1 percent Bajaj loan.

- No collateral is required when obtaining a loan from this portal.

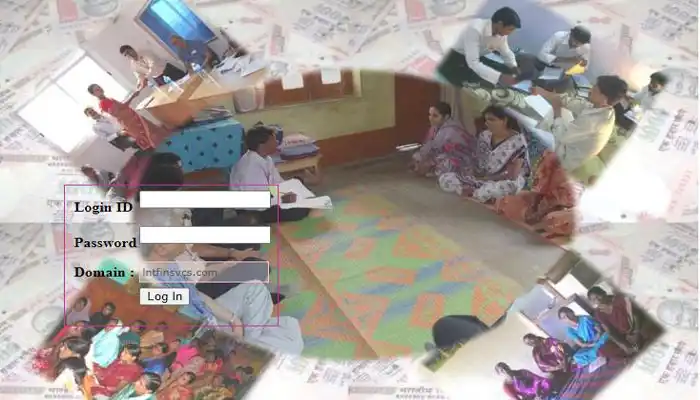

Mi-FLOW Web Portal MiFLOW Login Process?

Mi-FLOW Web Portal The MiFlow Login Process is very easy. If you encounter any difficulties during the MIFLOW web portal login, follow these simple steps to resolve the issue:

- Open any browser on your mobile device and type “MIFLOW” in the search bar.

- Click on the official Mi-FLOW website that appears as the top search result.

- The website will prompt you to enter your MIFLOW login ID, password, and domain.

- Review all the details carefully, and then click on “MIFLOW login” to access MI-FLOW.

Documents Required for MiFlow Loan Application

When applying for a loan through the Mi-FLOW web portal, certain documents may be requested, such as:

- Bank statements or proof of monthly income.

- Aadhaar card

- PAN card

- Ration card

- Passport copy, etc.

Ensure that the personal information on these documents is accurate. Additionally, keep in mind that this loan scheme is exclusively for women aged between 20 and 60 years.

Conclusion on MiFlow Login

MiFlow Login, powered by L&T Finance, offers a fantastic opportunity for aspiring entrepreneurs to secure loans of up to Rs. 45,000. With a focus on empowering women, this web portal provides a convenient and hassle-free loan application process.

To get started, log in to Mi-FLOW SSC and embark on your journey to expand your business with ease. We hope you found this information useful and encourage you to take advantage of the resources offered by MI-FLOW for your entrepreneurial endeavors.

FAQs on MiFlow Login

What is Miflow L&T Microfinance?

Microfinance is a banking service designed to provide financial support to unemployed or underprivileged individuals or organizations who would otherwise lack access to conventional financial services. It allows individuals to secure reasonable small business loans in a secure, ethical, and feasible manner.

What is the Full Form of MiFlow in English?

The Full form of MiFlow is the Microfinance Collection Repository Portal.

To Whom Does the MiFlow Web Portal Provide Loans?

The MiFlow Web Portal exclusively offers loans up to Rs. 45,000 to women.

Who is the Parent Company of the MiFlow Web Portal?

The MiFlow Web Portal is a product of L&T Finance, making L&T the parent company.